When is the best time to trade the Australian Dollar? Continuing our series where we analyze a market to discover the times of day when it is most volatile, and can offer the good opportunities for day traders, this week we take a look at the AUD/USD currency pair. The Australian Dollar is significant as one of the three major “commodity currencies” (the others are the Canadian Dollar, which we’ll examine next week, and the New Zealand Dollar).

The term “commodity currency” is used to refer to the denomination of a country which relies heavily on the export of raw materials, typically crude oil and natural gas, to generate its income. The term is therefore applicable to the currencies of a range of countries including Norway, Chile, South Africa, and Brazil, but it is most widely used to refer to the economically developed nations of Australia and Canada, each of which are enormous producers of fossil fuels.

Commodity currencies, when paired with the currency of a country that is a large net importer such as the United States, tend to be positively correlated to the price of raw materials, in particular oil. When oil prices fall, the value of the AUD/USD can also be expected to fall. Some traders even use the AUD/USD pair as an efficient way of gaining exposure to commodity prices, the currency acts as a proxy, behaving rather like a basket of commodity futures.

Just like the New Zealand Dollar, the Australian Dollar is also a favorite for the carry trade. A carry trade involves borrowing money in a country where interest rates are low (such as Japan), exchanging it for the currency of a country where interest rates are high (such as Australia), and then investing it in interest rate products such as government bonds.

The monetary policy of the Reserve Bank of Australia is to target inflation levels of around 2-3% per year, which has typically allowed for interest rates of between 2% and 8% in recent years.

Analyzing the Data

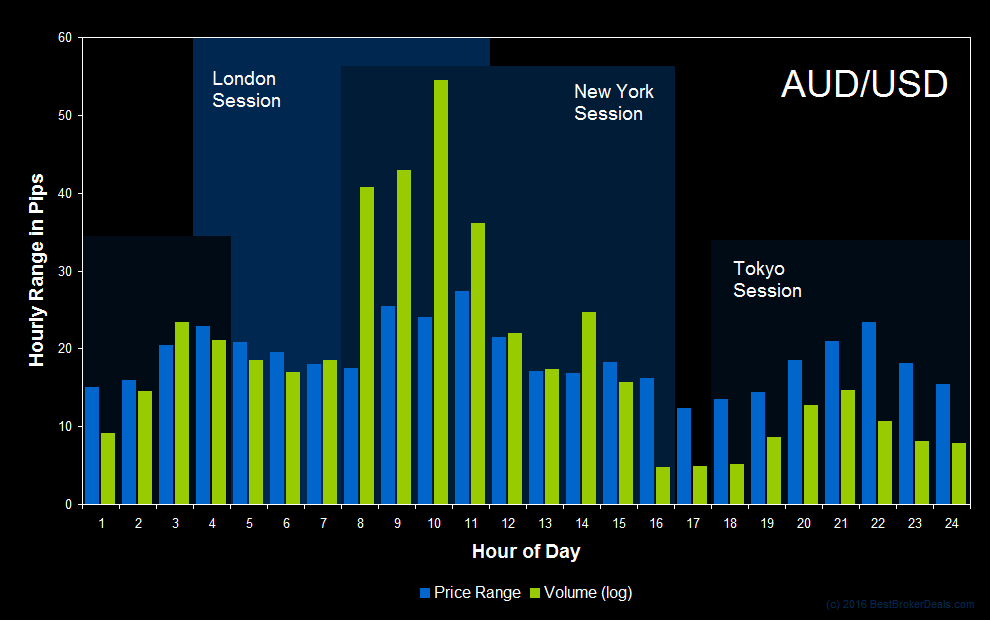

One again we’ll be examining a total of five years of intraday price data (providing roughly 250 data points for each individual hourly period), and we’ll be using quotes from the AUD/USD spot forex market. The hourly range in pips is used as a simply measure of volatility, and all times are EDT. Volume data has also been included on the chart below. This has been taken from the full size Australian Dollar Futures Contract (@AD) which trades on the Chicago Mercantile Exchange, and the data has been scaled to fit with the price data.

The Best Time to Trade the Australian Dollar

The AUD/USD pair appears to be notable for lower deviations in its volatility throughout the trading day. Although it is possible to identify the three characteristic peaks in volatility accompanied by higher volumes, these are both far less pronounced when compared to the troughs, and far less different from one another. The Australian Dollar perhaps has less of a ‘home’, and is consistently actively traded around the globe.

While volume is notably higher around the start of the US trading day, it should be borne in mind that some of this is due to the natural influx of liquidity at the start of the regular futures trading session.

Although the Australian Dollar trades with the fifth highest volumes of any currency (due in part to international trading of natural materials, and due in further part to the carry trade), this apparent absence of any predictably enhanced period of volatility suggests that it is possibly not the best choice for intraday traders who require significant directional price changes.

How to Use This Analysis

The great thing about this kind of statistical analysis is that you can incorporate it as part of an automated strategy with strict rules, but you can also use it as one of many inputs in a broader discretionary decision making process. However you trade, information like this should be useful.

Nevertheless, in the investigative spirit of this piece, I would encourage you to carry out your own research so that you can be absolutely confident in the results you see and their relevancy to your own strategies. All the research in this article was completed using TradeStation and the data was presented using Excel, but pretty much any good broker’s charting software will support this type of investigation.

| View the next article in this series: The Best Time to Trade the Canadian Dollar |