In this weekly series we have been examining different markets to determine the times of day when they tend to exhibit the greatest volatility, and may therefore offer the best opportunities for daytrading. Our last study covered the Australian Dollar, and this week we turn to the other major commodity currency, in an attempt to discover the best time to trade the Canadian Dollar.

Although it tends to trade with less volume than its Australian counterpart, the Canadian Dollar holds a stronger position as a reserve currency, being the fifth most held currency in the world after the US Dollar, the Euro, the Yen, and the British Pound. It accounts for around 2% of all global reserves, and remains attractive to central banks because of Canada’s relative political and economical stability and strong sovereign position.

Due to the image of a loon bird on Canadian one dollar coins, the currency is often referred to by forex traders as the ‘loonie’, a naming convention that was playfully extended to the two dollar coin as a ‘toonie’.

Analyzing the Data

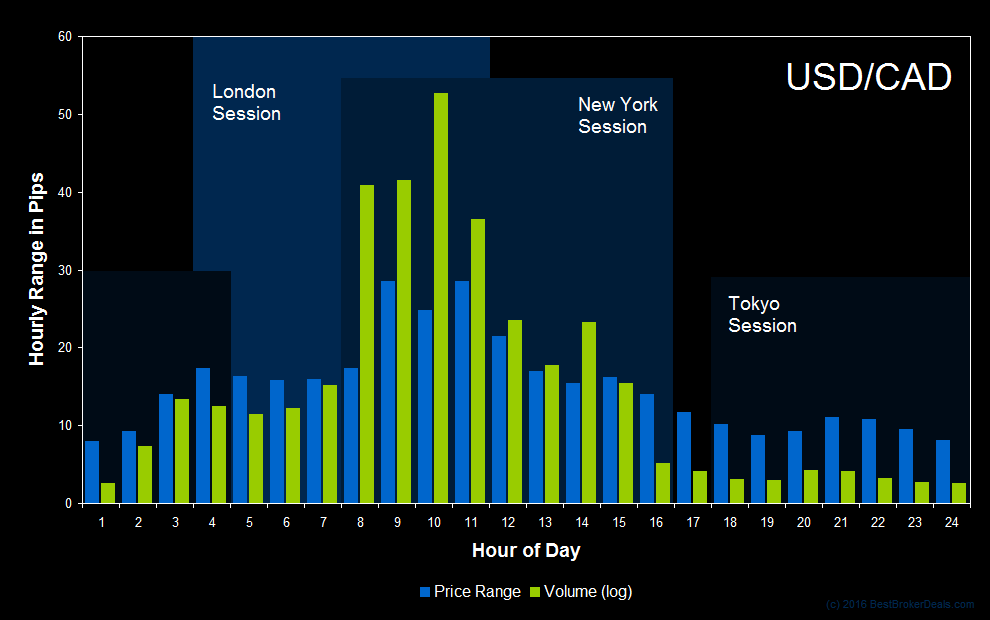

One again we’ll be examining a total of five years of intraday price data (providing roughly 250 data points for each individual hourly period), and we’ll be using quotes from the USD/CAD spot forex market. The hourly range in pips is used as a simply measure of volatility, and all times are EDT. Volume data has also been displayed on the chart below. This has been taken from the full size Canadian Dollar Futures Contract (@CD) which trades on the Chicago Mercantile Exchange, and the data has been scaled to fit with the price data.

The Best Time to Trade the Canadian Dollar

The Canadian Dollar displays some surprising differences from AUD/USD in its volatility profile. Peak volatility is clearly associated with the New York session, suggesting that there is relatively less interest in trading this pair from the UK or the Far East. Ignoring the fact that volumes are ramp up throughout much of the US trading day (the fact that the volume data has been taken from CME traded futures contracts is mostly responsible for this), volatility tends to track volume fairly closely, and it would be interesting to test for any kind of lead/lag relationship here that could form the basis of a trading strategy.

A further interesting point of investigation would be to determine whether overnight movements in the Australian Dollar in the Asian session are in any way echoed in the Canadian Dollar later in the same 24 hour period. While it is tempting to assume that modern day forex markets are so interconnected and efficient that all information immediately becomes priced in for all pairs, the reality is that huge sums of money are often concerned, and that much of the flow of capital can be more slow and cumbersome than we might expect.

How to Use This Analysis

The great thing about this kind of statistical analysis is that you can incorporate it as part of an automated strategy with strict rules, but you can also use it as one of many inputs in a broader discretionary decision making process. However you trade, information like this should be useful.

Nevertheless, in the investigative spirit of this piece, I would encourage you to carry out your own research so that you can be absolutely confident in the results you see and their relevancy to your own strategies. All the research in this article was completed using TradeStation and the data was presented using Excel, but pretty much any good broker’s charting software will support this type of investigation.

| View similar articles about currency trading: The Forex Knowledge Base |