Launching its first software products way back in 1982, TradeStation has been there since the beginning. One of the first brokers to offer online electronic trading, its high-spec charting platform became the blueprint from which many others were developed. Its reputation was built upon functionality and the capability to carry out serious, in-depth strategy analysis, and it is widely used by investment professionals and fund managers as well as retail traders.

TradeStation first entered the Forex Brokerage market in 2013, clearing trades through Gain Capital, and charging commissions under an ECN model. Following its acquisition of IBFX in 2011, however, TradeStation began to expand its offering internationally, with its flagship charting platform at the centre of this offering.

So, with such an assured heritage, does TradeStation still lead the pack for active retail traders? Does its charting package continue offer more bang for your buck when it comes to functionality and analysis, and can its strategy development platform continue to beat off the competition when it comes to automated trading? Read the full Tradestation review to find out more.

| Find out how TradeStation scores against other firms: Compare Forex Brokers |

Account Opening Proccess

Opening a brokerage account with TradeStation is relatively straightforward, but keep in mind that they are highly reputable Nasdaq listed firm, and that their requirements and checks are complete and thorough. Consequently, it can take a few days between completing the necessary paperwork online and being in a position to begin trading.

If this ever feels frustrating, keep in mind that the firm’s compliance with regulatory bodies in the US and the UK all adds to the security of the funds you deposit. Peace of mind is worth a wait!

Customer services are knowledgeable and helpful and will guide you through the account opening process, and our experience is that that there is none of the ‘pushiness’ that you get with some firms. If you need help you’ll probably need to be the one to pick up the phone and request it; the broker won’t chase your custom.

Charting

TradeStation charts are as good as you’ll find in any charting package. With each successive release they are tweaked and refined to improve usability based on customer feedback, and because this has been going on for three decades now the charting software is pretty flawless.

The TradeStation software is no toy, and as such it is best downloaded and installed on a desktop computer. This is probably not a solution for people wishing to dabble on their i-phones – we’re talking about an industry standard platform here, and that requires processing power.

A secure streaming version of TradeStation is available for all popular browsers along with a TradeStation mobile app for iphone and android devices.

A secure streaming version of TradeStation is available for all popular browsers along with a TradeStation mobile app for iphone and android devices.

These have the superficial appearance of something more modern and cutting edge, but in reality both have considerably reduced functionality, and apart from as a convenient way to monitor positions when you’re away from your desk, we wouldn’t hurry to recommend either.

If you’re interested in the features that set TradeStation apart from its competitors, then you’re interested in the desktop software!

As far as chart analysis goes, any common indicator or study you require is likely to be included in the standard installation, and a quick search online will uncover hundreds of more esoteric analysis plugins to download and install.

One small drawback of this is that until you know your way around the vast array of options it can sometimes be a little hard to find what you’re looking for. Be prepared to spend some time getting to know where the functions you need live!

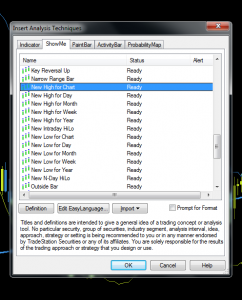

Studies are divided into three types in TradeStation.

Studies are divided into three types in TradeStation.

‘Indicators’ display as additional graphical information either within or beneath a chart; ‘Paint Bars’ color the existing bars or candlesticks on a chart when specified criteria are met; ‘Show Me’ studies plot dots above or below price when user-defined conditions such as a price formation complete.

All your chart settings can easily be saved, meaning that an exact chart setup is quick and easy to reload when you next log back in. In fact there are several ways to do this depending on whether you use multiple screens.

Indicator Groups – These allow you to insert a group of indicators of your choice into charts with a single click. So, ‘My Indicators’ could be an MA, an RSI, and Volume, for example.

Workspaces – A Workspace is everything that’s going on in a TradeStation window at the time you save it. If you have a 5 min chart of the Euro with three indicators, a weekly price chart for Yen, and a DOM screen for entering orders all open on your screen, saving as ‘My Workspace’ would enable you to re-open this whole setup whenever required.

Desktops – The Desktop simply takes the Workspace concept a step further, allowing you to reload multiple instances of TradeStation across multiple screens.

Session times can easily be customized, and audio alerts set for price levels or indicator triggers, with the option for text alerts if required. A whole host of drawing tools and screen sizing options are available, and charts can quickly be customised to display bars, candlesticks, or a range of more specific charting styles such as tick and range bars. And remember, if what you want (Kagi or Heiken Ashi, perhaps?) isn’t instantly available, EasyLanguage will almost certainly make it possible.

Analysis Tools

A further strength of TradeStation is the number of additional powerful information and analysis tools available to help you to make informed trading decisions. Some of these (such as news feeds) can easily be found elsewhere, but some are relatively unique to this broker platform.

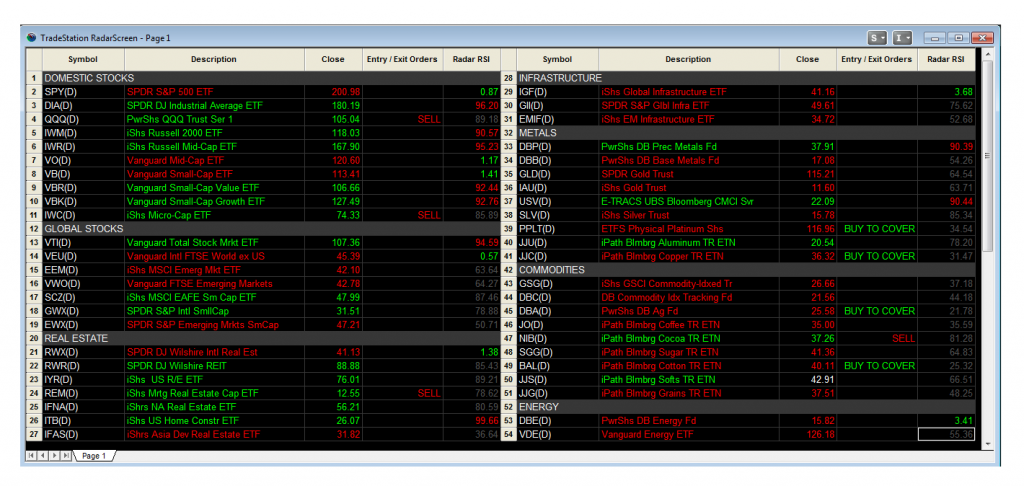

Radar Screen

The radar screen allows you to dynamically rank and sort hundreds of symbols in real time on one convenient screen, tracking market movers against measures of your choice.

Although similar applications are available in other platforms, in our experience the fact that this feature draws upon EasyLanguage outputs for its data means that it can be totally customized in a way that is fairly unique. As with the charts, if you can imagine it and a programmer can program it, then you can display this information in a radar screen. The radar screen is often used to track entry and exit signals across multiple markets, but it can also be employed as a method for displaying performance metrics in real time for positions held across an entire portfolio. If you’re holding positions in a dozen different currency pairs, then a radar screen is the ideal way to summarize all the information you need: lots held, profit and loss, value at risk, maximum drawdown or run-up; the possibilities are endless.

The radar screen is often used to track entry and exit signals across multiple markets, but it can also be employed as a method for displaying performance metrics in real time for positions held across an entire portfolio. If you’re holding positions in a dozen different currency pairs, then a radar screen is the ideal way to summarize all the information you need: lots held, profit and loss, value at risk, maximum drawdown or run-up; the possibilities are endless.

Scanner

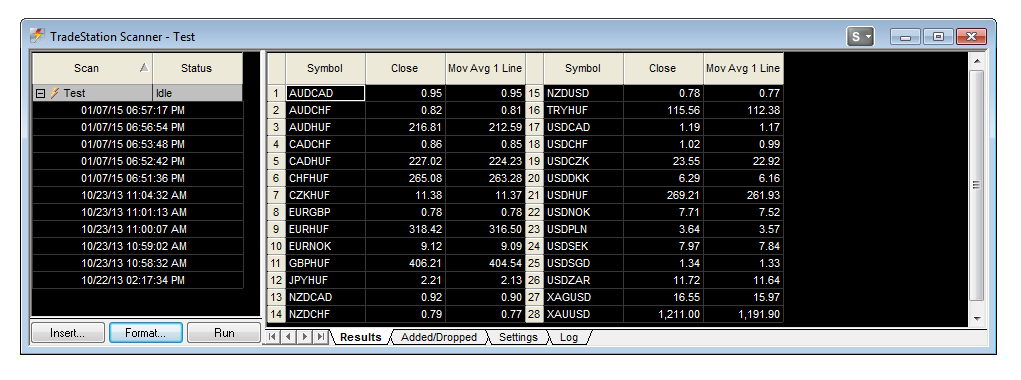

On the surface, the scanner bears some resemblance to the Radar Screen, in that both offer a way to process information from multiple markets according to criteria that can be specified in EasyLanguage.

Think of the difference this way: where the Radar Screen displays data about a list of markets you specify, the Scanner displays a list of markets matching a set of criteria you specify.

So, if you want to know which currency pairs are currently trading above their 200 period average but are undergoing a pullback sufficient to cause a 6 period CCI to fall below -100, then the Scanner would return a list of all forex pairs meeting these criteria.

To be perfectly honest the Scanner is probably a feature that is aimed more at traders of Stocks, as the universe of forex pairs is so small that this type of filtering can very quickly be done from charts or a Radar Screen. There is also a lot more information (from Dividends and PE Ratios to Institutional Ownership) available around stocks with which to filter; considering that even reliable volume information is not available for forex, sadly many currency traders will probably find this feature redundant.

EasyLanguage Strategies

Some of the earliest ‘Expert Advisors’ were developed within the TradeStation platform, although they’re not known as EAs – they’re simply referred to as “Strategies”. The functionality of a TradeStation strategy is almost unlimited – if you can imagine it, then it can be coded in the platform’s programming language (an object-oriented version of Pascal).

Some of the earliest ‘Expert Advisors’ were developed within the TradeStation platform, although they’re not known as EAs – they’re simply referred to as “Strategies”. The functionality of a TradeStation strategy is almost unlimited – if you can imagine it, then it can be coded in the platform’s programming language (an object-oriented version of Pascal).

Whilst you might not wish to learn the ins-and-outs of EasyLanguage programming for yourself, the platform has long been sufficiently well established that a whole host of professional EasyLanguage programmers are available to hire online, and an endless plethora of TradeStation code exists in the public domain.

Whilst you might not wish to learn the ins-and-outs of EasyLanguage programming for yourself, the platform has long been sufficiently well established that a whole host of professional EasyLanguage programmers are available to hire online, and an endless plethora of TradeStation code exists in the public domain.

As well as on numerous developer forums including TradeStation’s own Forum, it’s common to discover strategies written for tradestation in books and magazines dating back as far as the 80s, as well as in more recent publications such as Emilio Tomasini’s ‘Trading Systems: A New Approach to System Development and Portfolio Optimisation’. The TradeStation platform was particularly well adopted by futures traders, and so there is more weight in this direction in terms of what is available.

What has made TradeStation so popular with traders of automated strategies, however, isn’t just the ability to formulate system rules and execute trades, but the in-depth strategy analysis offered. TradeStation’s strategy reports tell you virtually everything you need to know about a strategy, with a dazzling array of metrics including industry measures such as Sharpe and Sortino Ratios.

For those who don’t want to immerse themselves in the details of programming TradeStation indicators or running back-tests, companies such as Delphic Trading provide a wide variety of analysis techniques and strategy ideas, as well as bespoke programming and back-testing services.

Until a few years ago portfolio analysis for strategies wasn’t possible within TradeStation, and software such as TradingBlox and TradingRecipes was the go-to for hedge fund startups with these analysis needs.

Until a few years ago portfolio analysis for strategies wasn’t possible within TradeStation, and software such as TradingBlox and TradingRecipes was the go-to for hedge fund startups with these analysis needs.

TradeStation were quick to close the gap though, and their Portfolio Maestro add-on offers advanced portfolio analysis capabilities at a fraction of the cost.

A powerful portfolio-level back-testing tool providing advanced analytics, optimization and performance reporting for traders at any level.

More recent developments in algorithmic trading have not been ignored, and though there is no inbuilt functionality for building neural networks or genetic optimisation, walk-forward sampling and portfolio analysis are both available. System trading with TradeStation certainly involves a learning curve, but the resources available to ease your journey are vast and there likely to be very few problems that you encounter that someone hasn’t already solved for you.

A more recent development is the TradeStation App Store, which enables you to access other programmer’s strategies and indicators on a month-by-month fee basis.

Data

Data is best streamed through TradeStation rather than from a third party source, although there are API options if you really need something else. Our experience has been that this is of the very highest quality available to retail traders, with few bad prints and fast corrections.

Tick data for all forex pairs is provided as standard when you open a forex account. You’ll also get delayed data for stocks, futures, and a handful of options, enabling you to gain a broader sense of how a currency price interacts with other markets.

As far as we are aware, subscription to real-time data feeds for other instruments such as stocks and futures is not possible within a TradeStation forex account. However, TradeStation have previously run promotions where real-time CME data was made available within forex accounts, suggesting that the barrier is not technical but one of broker policy. If you do require the option to trade multiple types of derivative from a single account then we suggest contacting a TradeStation representative to discuss your needs.

Execution

Order Entry Matrix

This is TradeStation’s term for what is often called ‘the ladder’ or ‘the DOM’. It shows. We’ve only ever used it for futures trading, and believe it represents one of the weaker areas of the platform in terms of execution.

Pretty much all the functionality you expect is there, but it is not quite as intuitively laid out as with other platforms.

As an example, the ‘flatten at market’ and ‘cancel all’ functions (you know, the “panic buttons” that you depend on when you’ve made some dreadful mistake!) is absent. So you need to be super-swift in reading off the information to know exactly what your position is and what you need to do to liquidate it – that can be tough in fast-moving and volatile currency markets.

Exit brackets can be used, but these must be individually and manually set, and cannot be retained as auto brackets. While it is true to say that any kind of complexity of bracketed exit you require can be implemented with an EasyLanguage strategy, it is a shame to find this functionally absent from the Matrix.

If you’re a high frequency scalper and you work from the DOM to execute trades, then we’d recommend spending some time in a simulated account to become accustomed to the Matrix before using it for live execution.

Chart Trading

TradeStation’s Chart Trading feature allows discretionary traders to intuitively place and edit orders directly on a chart in real time.

TradeStation were a little late in adopting this concept for obvious reasons: their customer base has tended towards non-discretionary trading. The upside of this is that their Chart Trading feature is powered by EasyLanguage. This means that you can extend it to meet your own unique trading needs or use it as the basis for your own analysis techniques.

- Place single- and multi-leg orders with a simple mouse click

- Easily move orders to new price levels by dragging the order line

- Edit orders with a right-click

- View position details and easily close or reverse a position

- Place commonly used orders – including hit/take, market, OCO, and trailing stops – with a button click.

Automated Strategies

With automated trading, TradeStation comes into its own. Provided the code is correct and you have a stable internet signal, you can pretty much sit back and leave TradeStation to it. This is a robust piece of software with a pedigree for automated strategy trading, and short of trying to run an algorithmic HFT operation from your garage, TradeStation will likely be up to the task.

A few caveats to be aware of, neither peculiar to this broker: make sure you correctly set your execution preferences (chiefly whether you want non-marketable orders to be held on the book or server-side), and make sure you build risk management safeguards into your strategy.

Commissions & Fees

The forex pricing structure with this broker offers commission-free trading with tight spreads and fractional pips.

TradeStation makes money on each forex trade through a small markup embedded in the spread (the difference between the bid price and the ask price).

This broker operates a Straight-Through-Processing model (STP), passing orders to an internal pool of liquidity providers who compete to fill your orders at the most favorable price to you. No exchange fees are applicable.

We should add that there is an exception to this – the TradeStation Institutional Account, or Ifx, which offers inter-bank ECN connectivity through the likes of Integral or Currenex, and also execution services through third-party trading platforms.

Contact a TradeStation Institutional Sales Rep for further information about this.

Platform Fees

Unlike accounts for securities and futures trading with this broker, there is no platform fee for forex trading accounts. While various limitations have been placed on the software because of this, all analysis features and data streams remain fully present for forex instruments.

Inactivity Fees

TradeStation does not charge an inactivity fee for forex accounts.

Educational Resources

Dating right back to its early days as Omega Research, TradeStation has always offered a wealth of educational and training materials. These range from general market analysis and trading ideas through to platform specific guidance and EasyLanguage Bootcamps. Throw into the mix the huge amount of resources that are available for this platform from third parties and you will struggle to find a broker with a better documented offering.

TradeStation Review Summary

TradeStation is a heavyweight platform for the serious trader, with unparalleled capabilities for strategy analysis and research. It’s brokerage service is better than most, and the low-cost access to the platform for forex account holders is not to be missed.

If you’re left in any doubt about the strength of our recommendation here, TradeStation is the platform that we use to provide all the analysis and graphics we share on this site, and where we research and develop all our own trading strategies. Some of these are implemented in accounts with other brokers, but for charting and strategy analysis we think that TradeStation is second none.