You’ve probably heard the well-known saying, “sell in May and go away”, which suggests that stock market gains over the summer months are typically minimal, but is there really any truth in this old piece of market wisdom?

The advice is aimed squarely at investors holding long positions in stocks or indexes, and implies that one might consider selling all holdings in May in order to preserve gains generated earlier in the year.

Now, if you’ve much experience trading in the financial markets then you’re probably thinking something like “if only it were all that simple!” But sometimes simple strategies can really work, providing the most robust results over the long run (take ‘trend-following’ for example). What’s more, like many old sayings, these market adages often have some basis in truth.

Of course, before making trading decisions based on any information, whether it’s a well known saying or advice from a successful fund manager, it’s essential to run objective, quantitative tests to determine the historical viability of a concept. Sometimes this is easy, but when it comes to the “sell in May and go away” adage there is an element of vagueness because the advice isn’t specific on either when within the month to “go away”, nor when to return.

Seasonality in the Stock Market

The “sell in May and go away” adage is really nothing more than a description of a seasonal tendency in stock markets, and the real question we are asking is: do some months produce noticeably better returns than others, and do some groups of adjacent months produce noticeably better returns than others?

For the purposes of our study I’m going to assume that we are interested in holding for a eight month period commencing at the end of September and ending on the last day of May. This eight month period is somewhat arbitrary, and you might wish to test shorter or longer holding periods.

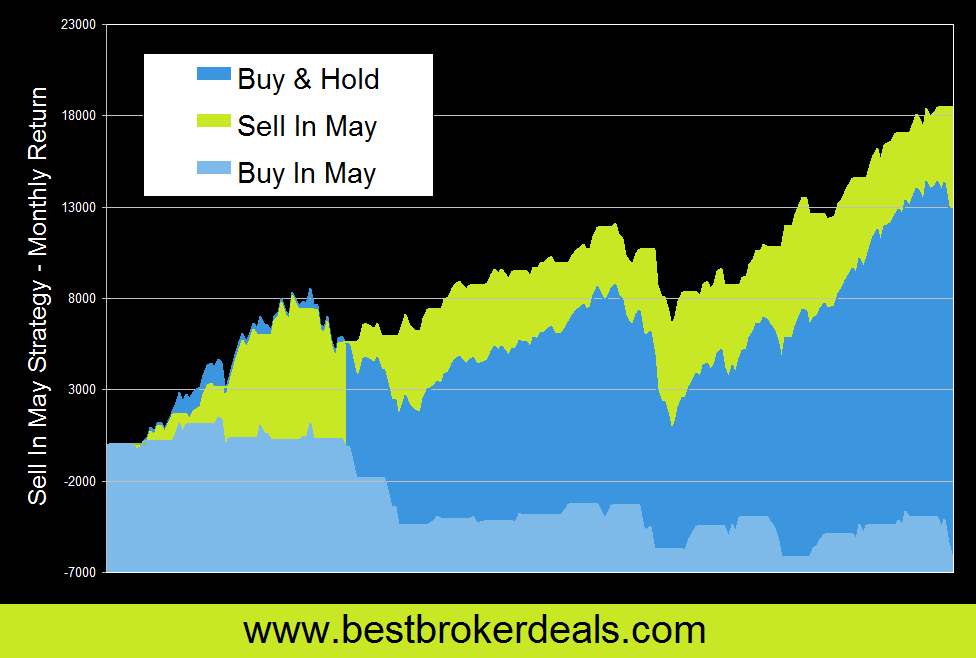

Before we look at whether this eight month holding period is actually any better than the other twelve possible eight month holding periods, let’s start simply by looking at how well the “sell in May and go away” strategy, has performed compared to a plain vanilla buy-and-hold strategy. I’ve also included a test of the inverse of the strategy, buying in May and selling in October. These tests use the S&P500 exchange traded fund (Ticker: SPY), no deductions have been made for commissions or slippage, and the results do not include dividend payments.

“Sell In May and Go Away” – The Results Are In!

I’m sure that this chart doesn’t require much explanation – it’s fairly clear that historically the months of June to October have under-performed, whilst the months of October to May have outperformed the index.

If you’re looking at this graph and thinking that the degree by which the strategy has outperformed Buy and Hold isn’t very much, then keep in mind that most professional fund managers (we’re talking about managers of tens of millions of dollars) fail to consistently beat the index, whereas this strategy has done so by an average of 3.4% per year over the test period. What’s more, it has achieved this whilst being in the market only 67% of the time, which means a significant reduction in exposure to market risk.

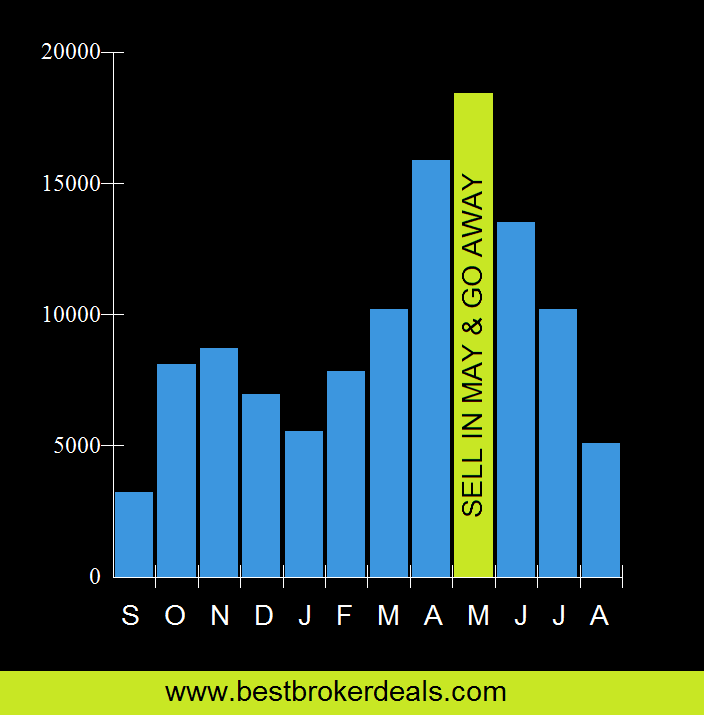

The next thing that we want to know is how this eight month period’s performance compares with that of each of the 11 other possible eight month holding periods (such as “sell in March and go away”). The chart below shows the returns for strategies using each possible sell month.

The picture here is clear: not only does seasonality seem to be a relevant factor in US stock indexes, but the best period to exit the market after an eight month holding period if indeed May. So, there’s certainly been a substantial degree of truth in this saying if the past few decades are anything to go by!

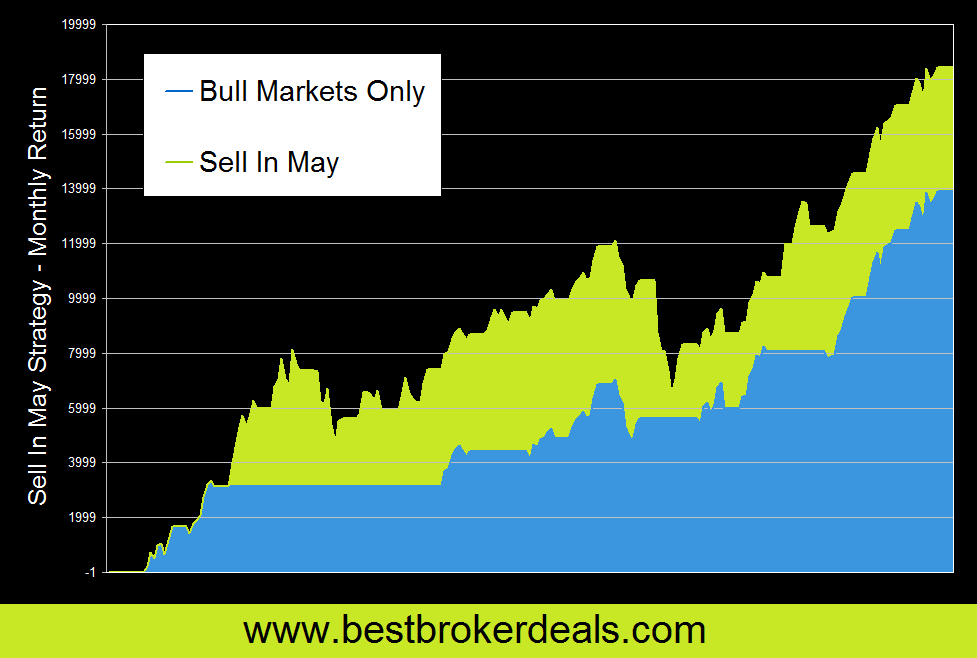

I’m going to finish our investigation with one final test. The following chart shows the results for this strategy when we use a 200 period simple moving average of the daily closing price as a filter for bull/bear market regimes, taking long positions only when the market is trading above its average. This should, in theory, ensure that we don’t invest during prolonged bear markets such as those we saw around the dot-com or sub-prime crashes.

Though it has reduced drawdowns, this filter has also reduced our net profit, not to mention keeping us out of the market for prolonged periods.

How to Exploit this Seasonal Tendency

Although the evidence we’ve seen here is that the saying “sell in May and go away” has some credibility as a description of seasonal tendencies in the stock market, it probably shouldn’t be used as an investment strategy in its own right. It might be better used as a filtering condition for other long strategies, perhaps reducing position sizes for these summer months rather than exiting the market completely.

So, the next time you hear one of these old sayings, don’t be too quick to dismiss it! On the other hand, as this article has hopefully demonstrated, we should also be careful not to dive in without thorough testing and analysis of a strategy’s historical performance. And the usual caveat applies to this just as much as any other strategy: don’t be too surprised if the future doesn’t quite mirror the past.

| View similar articles about investing in stocks: Stocks Knowledge Base |