Diversification is often touted as “the only free lunch in finance”, but what exactly does diversification mean, and how can it help your trading?

Diversification is often touted as “the only free lunch in finance”, but what exactly does diversification mean, and how can it help your trading?

In this article we’ll look at some clear visual examples of this powerful concept, and explore some of the concrete benefits that you can gain from diversification in your trading. We’ll also discuss some of the less obvious ways to achieve diversification and reduce risk for those who don’t hold large investment portfolios.

How does diversification work?

At the core of diversification lies a simple concept – when a wide variety of different investments are held together within a suitably configured portfolio, the portfolio can yield higher returns and present a lower risk than any individual investment contained within it.

This is possible because the positive performance of some investments can neutralise the negative performance of others, thereby smoothing returns and eliminating systemic risk.

For this counterbalancing to work, the components of a portfolio need to behave differently to one another. In statistical terms, their movement must not be positively correlated (correlation coefficients range from +1 to -1).

The easiest way to think about this is to consider the daily price of two securities, Stock X and Stock Y. Although both stocks could rise over the course of a month, they might move in opposite directions on a daily basis, thus making ideal candidates for inclusion in a diversified long portfolio.

If you wanted to be long Stock A but short Stock B, on the other hand, then an ideal scenario would be for both securities to be positively correlated. This has the added benefit of providing a level of what is termed “delta-neutrality”, which means that your portfolio is less susceptible to broad market shocks – in the event of a market crash, profits from your short position in Stock B will hopefully help to offset losses from those of your long position in Stock A.

One pair of assets that frequently exhibits negative correlation is stocks and bonds. When the stock market appears to offer a lower return, then the risk free yield of bonds will become more attractive, driving prices higher. Similarly, in times of crisis, cash often flows away from equities and into perceived safe-havens such as gold.

The info-graphic above shows the performance of a 50/50 portfolio blend of 20 Year Treasury Bonds and the S&P500 index, as well as that of each component.

Will it help me make more money?

Diversification might well reduce the volatility of your investments, but will it actually leave you any richer? Probably, and it’s all about what happens when we factor compounding into the process . . .

Diversification might well reduce the volatility of your investments, but will it actually leave you any richer? Probably, and it’s all about what happens when we factor compounding into the process . . .

In the example above, you saw how the 50/50 portfolio underperformed stocks in terms of return over the period shown, albeit with lower risk.

But when you start to apply position sizing formulas to compound these returns, the low volatility becomes a powerful ally; compounding works much better with smoother equity curves and usually results in greater profits.

Once position sizing comes into play, a strategy with lower returns but a smoother equity curve will typically outperform one with a volatile return stream.

Looking Further Afield . . .

In today’s global markets, finding securities that bear no correlation to one another is increasingly difficult. One useful route is to include investments in foreign securities within our portfolio, as these will often be less closely correlated with domestic stocks. A downturn in the US economy may not affect Japan’s economy in the same way, for example, so holding a number of Japanese securities within a portfolio could help to offset losses from a downturn in the US.

Can I afford a diverse portfolio?

Diversification needn’t necessarily be expensive. The first thing to remember is that whenever you hold a position in any kind of index, then you’re already diversifying across a wide range of stocks. Many of these stocks will be positively correlated, so this isn’t an ideal form of diversity, but you’ll typically experience less volatility than you would if holding any single constituent stock.

Next, consider the wide range of derivative products that are available for you to access. Mutual Funds and Exchange Traded Funds are a very affordable way of gaining exposure to a market, especially over the long term, and a portfolio of index ETFs is an easy and cost effective way to diversify.

Several strategies that are well suited to traders looking to diversify using ETFs are described in the book “The Ivy Portfolio” by Faber and Richardson, including long term trend following and relative strength models.

What if I only trade one market?

Then diversification can still help! But instead of diversifying across several markets within a portfolio, you need to think in terms of a ‘strategy portfolio’ for your chosen market. Just as with the multi-market portfolio, negative correlation is the key here, and you will need to find strategies (rather than markets) that exhibit negatively correlated returns.

You might do this by trading, say, both a trend following and a reversal system alongside one another. When market conditions favour big moves, then the bulk of profits will come from the trend following system, and when the market is range-bound and this strategy underperforms, a strong return will be provided by the reversal system. As long as both strategies are net profitable and their return streams are negatively correlated, then trading the two from one account will almost certainly help to smooth the equity curve.

Take a look at the chart below, which shows the returns for both a trend following strategy and a mean reversion strategy in S&P futures, along with the equity curve that could be achieved by trading both strategies alongside one another. Diversifying across strategies with negatively correlated returns reduces volatility.

What’s the best way to configure my portfolio?

In both of the examples that we saw above, two negatively correlated streams of returns (from stocks and bonds, and from the two futures strategies) have been combined in equal proportion.

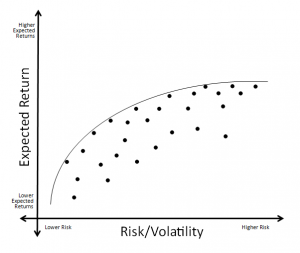

In practice, this may not be the most efficient way to weight a portfolio. Bonds, for instance, may only be half as volatile as stocks. In order to offset losses from stocks effectively, the holding in bonds would need to be twice as large as that in stocks. This concept is known as “Risk Parity”. Along with expected returns and correlations, the anticipated risk is an input in the process known as “Mean Variance Analysis” which aims to identify the optimal composition for a portfolio.

By an optimal composition, we mean one that offers the maximum possible return for a given level of risk. Different investors have different appetites for risk; using mean variance analysis aims to ensure an optimal outcome within this.

By an optimal composition, we mean one that offers the maximum possible return for a given level of risk. Different investors have different appetites for risk; using mean variance analysis aims to ensure an optimal outcome within this.

The simplified chart on the left shows the principle of Mean Variance Analysis at work.

Each of the points represents a possible portfolio measured in terms of both risk and return. The points on the line sit at the “efficient frontier”, which means that they represent an optimal combination of securities, maximising return for a given level of risk.

Modern Portfolio Theory

Modern Portfolio Theory” is a more rigorous mathematical approach to the problem of effective diversification, and holds that an “efficient frontier” exists for any portfolio, providing the maximum possible return for any given level of risk.

The only free lunch in finance?

Diversification (along with Position Sizing and Risk Management) is one of the key techniques that sophisticated traders and investors rely upon to ensure that their capital continues to grow. Though this article has provided only a brief outline, it should have demonstrated that diversification is a powerful tool to incorporate into your trading, and have provided some starting points for further investigation.

| Find the right broker for your trading needs: Compare Brokers Now |