Stop orders are a basic type of order and are available with all futures brokers. A stop order can be used either to enter or exit a position, and in many ways it can be considered the mirror or opposite of a limit order.

Using Stop Orders for Futures Trading

A buy stop order must always be placed at a price above the level at which the market is currently trading. If the market trades up to the level at which you placed a buy stop order then your order will be filled. Sell stop orders are always placed below the current market level, and are filled only when price trades down to them.

How Stop Orders Are Filled

A stop order isn’t actually an order type that is recognized by the futures exchanges, it is held by your broker on the firm’s servers. When the price touches a stop order you have placed it is automatically converted into a market order by your futures broker and then transmitted to the exchange where it will be filled.

For a buy stop order to be filled it must be matched with the best (lowest) sell limit order placed with the exchange. A sell stop order is matched with the best (highest) available buy limit order.

Viewing the Stops of Other Traders

Because it executes immediately that it reaches the exchange as a market order, stop orders do not sit on the exchange’s books, and so it is not possible to view the stop orders of other participants.

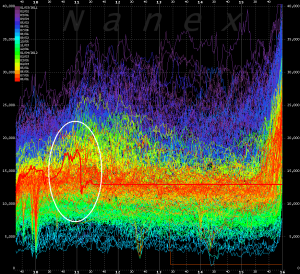

TIP: Although it is not possible to view the stop orders of other traders before they are executed, once orders are filled they contribute to the ‘volume at bid’ (sell stops) or ‘volume at ask’ (buy stops) information that you can monitor from your charting platform. By studying this information it can be possible to make accurate predictions about where other participants may have placed their stop orders, and many interesting strategies can be developed from this concept.

Slippage on Stop Orders

When you trade with a stop order and price reaches your stop, your order is guaranteed to be filled. Because it can only be filled by available limit orders, it is possible that it will be filled at a higher price. When this happens it is known as slippage.

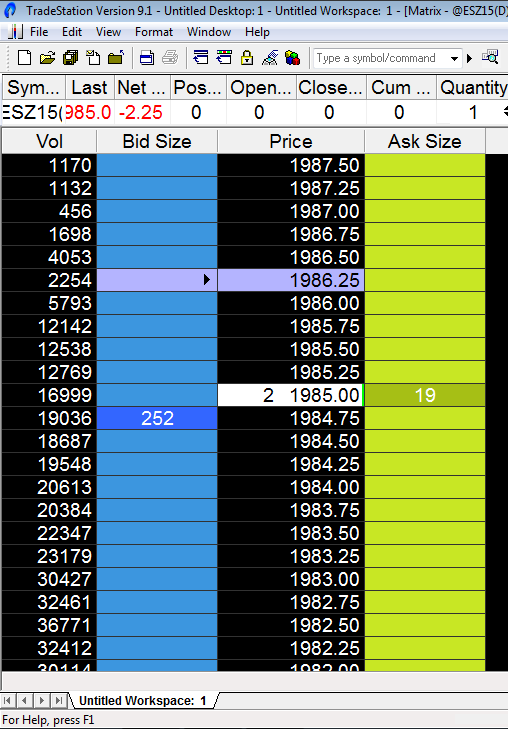

Take a look at the image below, which shows the depth of market for a liquid futures contract. If your buy order for one contract were to be triggered at this moment, it would be filled by one of the 19 sell limit orders at 1985.00. Your order would have jumped ahead of the limit buyers at 1984.75.25 to ensure a fill, but in doing so you have had to pay the spread (the one tick difference between the bid and ask) of 0.25, or $12.50. If a much larger stop order for 50 contracts was triggered ahead of yours there would not be enough limit sell orders available at 1985.00, and after 19 orders had filled then the remaining orders, including your own, would fill at 1985.25 where a further sell limit orders await. This would have resulted in one tick of slippage for you in addition to the spread.

The Pros & Cons of Stop Orders

| ADVANTAGES | DRAWBACKS |

|

|

Using Stop Orders as Stop-Losses

It is very common to use stop orders to exit un-profitable futures positions in the form of a ‘stop-loss’. For example, if you have entered the S&P eMini ES futures long at a price of 1985.00, then you might choose to place a stop order at 1979.00 to limit your losses on the position to $300.

Because a stop-loss order can be placed at the same time a position is initiated it can provide an effective way to manage risk.

TIP: It’s often possible to set up a group of three connected or “bracketed” orders on your broker’s platform. You can place an entry order such as a buy stop along with a conditional sell stop loss and sell limit profit target. If your entry order is filled then the stop loss and profit target orders will be sent to the market. These are accompanied by an OCO or “one cancels other” instruction, meaning that when either your stop or target is hit to exit the trade, the remaining superfluous exit order is then cancelled.

| View similar articles about investing in futures: Futures Knowledge Base |