The terms ‘contango’ and ‘backwardation’ refer to a phenomenon that is unique to futures and the way they track an underlying market. Although advanced strategies can be built around the opportunities that contango and backwardation present, for most futures participants these circumstances are not significant and are simply a matter of casual interest.

If you’d like to know about specific strategies to take advantage of contango and backwardation then take a look at this article from Futures Magazine. And if you’re just curious to learn a bit more about this phenomenon then read on!

What is Contango and Backwardation?

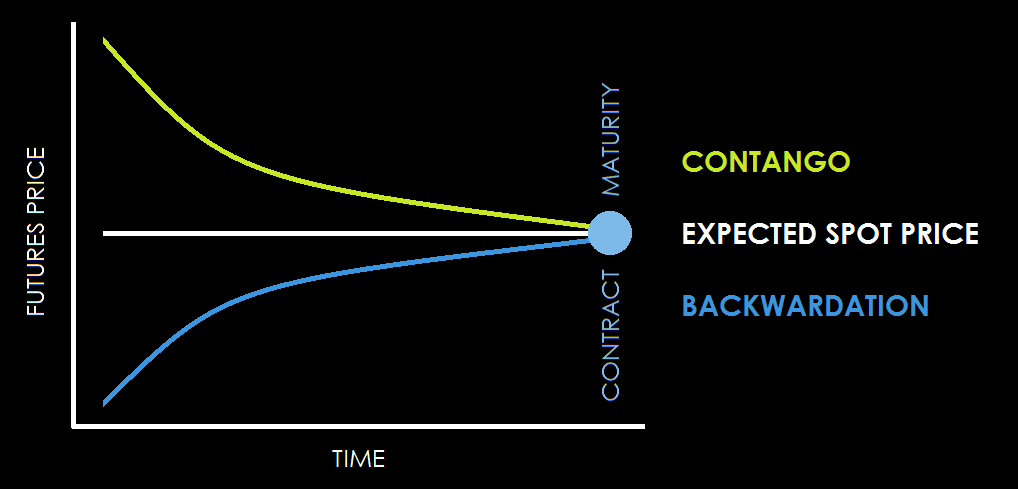

Contango and backwardation are really mirror images of the same scenario. Contango occurs when the price of a futures contract is trading above the expected value (at the time of maturity) of the underlying commodity in the spot market. Backwardation is a situation where the futures price of a commodity is lower than the expected spot price. In both cases, the difference between the futures price and the spot price is known as the ‘basis’.

Why Does Contango and Backwardation Occur?

Futures contracts roughly track the price of the underlying commodity or asset relatively closely. Ultimately the contracts will be fulfilled by the delivery of this underlying at the settlement date, so it is natural that the value of the futures contract remains the same as that of the underlying.

There are, however, certain other expenses that must be factored into the price of a futures contract such as the storage and carry costs of the commodity. The willingness to pay a premium in the price of the futures contract rather than stand these costs can be one cause of contango.

Spot markets can be illiquid and the expected futures spot price cannot be known with any certainty. Futures prices are determined in a highly liquid two-way auction process, and are impacted upon by the actions of a great many participants with differing agendas. Simply, the cost of the underlying commodity is not the only supply and demand factor involved in futures price discovery.

While prices may drift somewhat from the underlying, instances of extreme contango and backwardation are very rare. Notable examples include the 2007 contango in the wheat market, and the backwardation of the commercial gas market in 2013.

DID YOU KNOW? DID YOU KNOW?The two terms originated on the London Stock Exchange in the mid 1800s. Backwardation was a fee paid by a seller in order to defer delivery of stock that they had sold. The fee was paid either to the buyer of the stock or to a third party who lent the stock for short-selling. |

| View similar articles about investing in futures: Futures Knowledge Base |