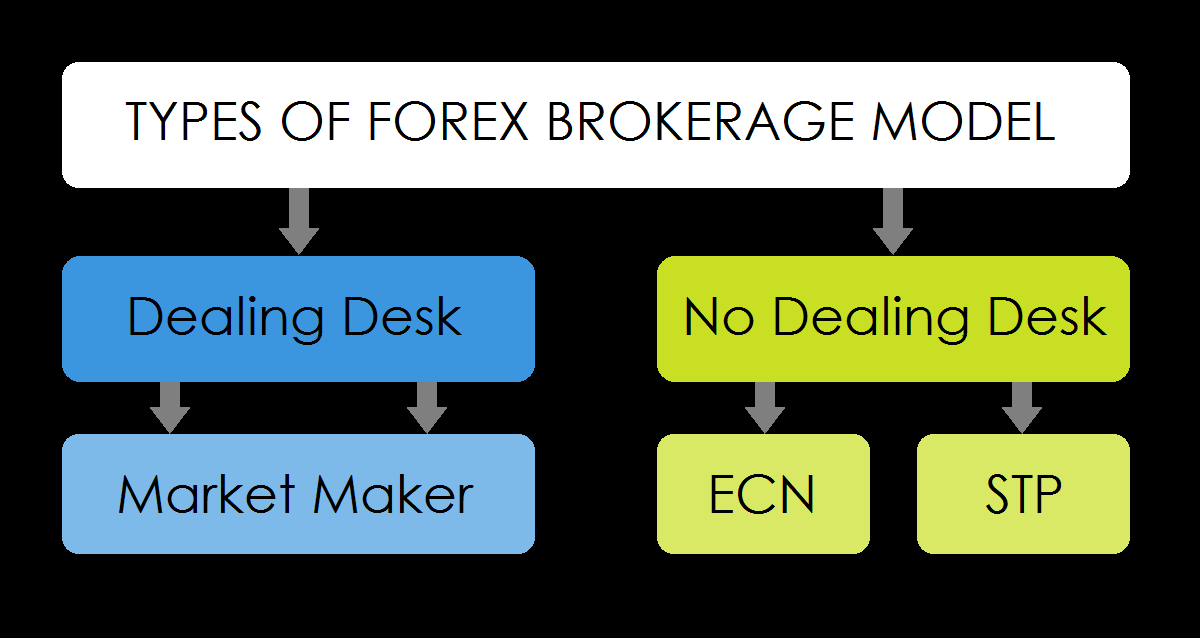

The question of whether to use a brokerage firm with an ECN vs Market Maker model is one of the first that prospective forex traders must seek to address.

Market Makers are often given a bad press when compared to ECN brokers, but the truth is that each type of model has both advantages and disadvantages, and your choice between the two will depend on your individual circumstances and financial goals.

In this brief ECN vs Market Maker article we’ll be taking a look at what each broker model entails, and then talking through the pros and cons of each so that you can make an informed decision when choosing what type of broker to open an account with.

But first, let’s try and gain a clear idea of exactly what these two terms mean . . .

ECN Brokers

ECN stands for ‘Electronic Communications Network‘, which is a network of institutions providing deep liquidity in the interbank market.

When you submit an order to via an ECN broker your order is executed by matching it with one of these liquidity providers. Because these liquidity providers compete with one another for order flow, executing via an ECN means reduced spreads, allowing you to get filled at the best possible price.

The broker’s role is passive: they simply provide the technology enabling you to find a counter party for your order. For this they typically charge a commission.

Market Maker Brokers

Brokers operating a Market Maker model typically have a dealing desk (they are sometimes referred to as ‘dealing desk’ brokers). The desk “makes the market” by quoting a bid and an ask price, and in the first instance attempts to offset one customer’s orders against another. Where this is not possible the broker takes the other side of the trade directly and then looks to offset, or “hedge” their risk, with an external liquidity provider.

Market Makers may choose not to offset all of their risk and “skew their book” instead, meaning that they take the other side of a client’s position – this is often known as “bucketing” orders.

Courtney Gibson, Vice President of Trading at dealing desk broker OANDA, explains the model well:

The way that we run our system is to create that consensus price view where we price our customers and then we take care of the smart order routing problem about how we split up the trades, who do we send them to, can we do some netting internally, etc.

Some Common Misconceptions

Don’t be drawn into thinking that dealing desks are inherently undesirable – there are advantages to be gained on both sides of the ECN vs Market Maker debate.

All your orders, no matter how or where you trade, will ultimately be passed through a dealing desk. And the people on that desk are a counter-party to your order and therefore in conflict of interest with you. As this article points out, it hardly matters whether your counter-party is the desk in a bank making markets on and ECN, or the desk at your broker.

Pros & Cons of ECN Broker Model

| ADVANTAGES | DRAWBACKS |

|

|

Pros & Cons of Market Maker Model

| ADVANTAGES | DRAWBACKS |

|

|

ECN vs Market Maker: Which is Better?

Having studied the information above, you should have a pretty good understanding of the main differences between these two types of broker and the major pros and cons of each model.

There is no straightforward way to settle the ECN vs Market Maker debate: only you can decide which will be better suited to your personal circumstances and execution requirements. A common path for many traders is to begin with a small account with a Market Maker and then progress to an ECN when fewer safety nets are required. Of course, many successful traders remain with a dealing desk broker and find that this works well for them.

| View more articles about forex trading: Forex Knowledge Base |