A Simple Guide to Choosing a Forex Broker

Apart from your trading strategy, choosing a broker is one of the most important decisions you’ll make. Naturally, you’ll want to trade with the best broker, and you’d like to know which firm that is, right?

Unfortunately there is no conclusive catch-all answer to this question, and there are hundreds of brokerage firms out there to choose from, offering what might seem like a bewildering array of products.

Though there is no “best broker”, there is certainly a broker out there that is best for you, and can provide the service you need to achieve your specific trading goals.

Knowing the right questions to ask, and having the information to answer these questions at your fingertips, will mean that you can quickly find that perfect match. And that’s exactly what this guide will help you to do . . .

Asking the Right Questions

Though it is by no means exhaustive, the following list should cover most of the key factors that you will need to consider to make an informed choice of broker:

- Products – Does the broker offer the derivative or security that will be the best for implementing your strategy?

- Countries – Does the broker accept clients from your country of residence?

- Account Size – Can you meet the minimum account size available with the broker?

- Leverage – Does the broker permit enough leverage for your strategy?

- Fees – What spread or commission does the broker charge? Are there other charges associated with an account?

- Platforms – Do you require a charting and execution platform with advanced features?

- Security of Funds – Is the broker registered with a financial regulation authority?

- Customer Service – Does the broker have a strong reputation for customer service, and will you be able to get help when you need it?

THE AMERICAN BUCKET SHOPS OF THE 1890s

This term originated in the States in the late 1800s, where brokers would meet the needs of a public with an appetite for speculation. A bucket shop literally “buckets” orders. Rather than covering them in an underlying market to hedge exposure, the bucket shop acts like a bookmaker, taking the other side of a speculative bet.

This can become an issue because it creates a conflict of interest; your loss is the broker’s gain. More information on bucket shop brokers can be found in Edwin Le Fevre’s classic biography of Jesse Livermore, one of the greatest speculators in history ‘Reminiscences of a Stock Operator’.

Choosing a Broker – Practical Example

Let’s look at a hypothetical example to show how answering these questions can lead to a rewarding and profitable decision when choosing a broker to trade with . . .

Suppose that you’re looking to open an account to trade a new strategy that you’ve developed . . . Your first choice will be which instruments you wish to use to implement your strategy. Your trading plan requires that you be diversified across multiple markets, much like a fund manager or commodity trading adviser would wish to be. But your trading capital is limited to just $15000, so you don’t have enough to finance positions in leveraged futures markets. The obvious choice here is to trade a portfolio of Exchange Traded Funds. ETFs trade like shares on the major stock exchanges, so you’ve immediately narrowed down your field of inquiry to brokers of stocks.

Your equity trading strategy involves re-balancing your portfolio on a monthly basis, so you’ll be trading fairly infrequently. In order to not be penalized for this you need a broker who does not charge a maintenance or inactivity fee. Once again, you’ve narrowed down your search.

Next, you begin to consider the costs involved in trading – the commission you will pay when you buy or sell a stock. Because your account is small and you’re dividing your capital amongst numerous stocks, the number of shares you will trade will be small – perhaps just a dozen of each stock. A broker who allows you to trade large blocks of shares for a fixed commission is of little benefit here – you’ll be trading so few shares that this fixed commission will work out very expensive on a per-share basis. You’re now looking for a broker who offers a per-share commission.

You’re now down to just a few options. Executing just a handful of trades once per month, you’re really not interested in advanced charting features, or even real-time data feeds. A broker with a basic web-trading platform for market-on-close executions will be more than adequate, so you decide there is little point paying a monthly premium for charts.

So, you’ve reduced your field of search to one brokerage firm – let’s call them Acme Brokers – who seem a great fit for your trading needs, but there are a few final things to check . .

This is the “due diligence” step. A quick bit of research online tells you that Acme Brokers is regulated by the SEC, has an AAA rating from Moody’s, and maintain segregated accounts for their customer’s funds. So Acme Brokers are looking like a pretty great choice for you!

There’s just one more remaining step before you start filling out the paperwork to open your account there – head over to www.bestbrokerdeals.com and see if the broker is currently offering any kind of promotional rebate or incentive!

TAX REPORTING . . . A further thing to take into consideration is your tax position. Your trading activities may or may not create a tax liability, and this will depend on both your personal financial circumstances and local tax provisions. There can be advantages in terms of both transparency and reporting if you trade through a broker in the same country in which you are domiciled for tax purposes. In some jurisdictions there exists the potential to offset unprofitable investments as a tax loss, and in some countries such as the UK derivative products such as Financial Spreadbetting carry no tax liability whatsoever.

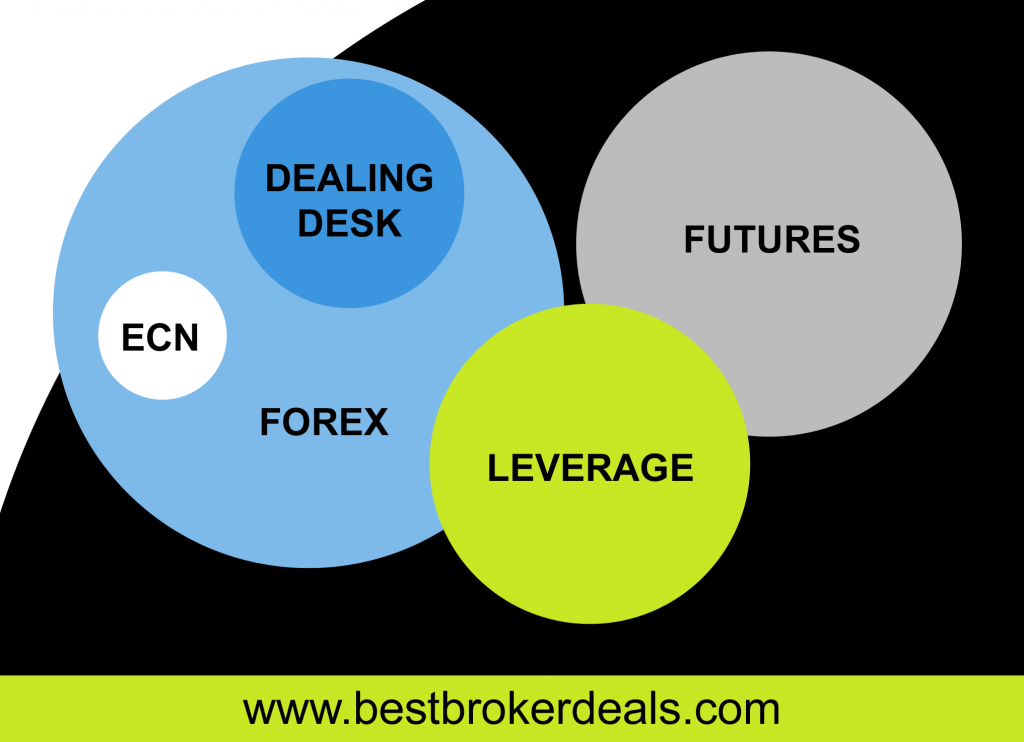

Different Types of Broker

ECNs, FCMs, STPs . . . the names alone can be confusing if you don’t know what they mean! All brokers will enable you to execute the orders you need to open and close your trading positions one way or another, but how and where they do it can vary significantly. Here’s a quick low-down on the terminology you need to know to make sense of the products on offer:

Most brokers now offer a discount brokerage service, even if they also act as full service brokers. Choosing a broker that offers a discount service means that they will typically charge a much lower commission because you will execute your own trades electronically. Discount brokers may also match customer buy and sell orders within the firm’s own order book rather than via an exchange.

| PRIME BROKER | A Prime Broker principally provides services to hedge funds and other professional investors, ensuring the liquidity to execute large trades, as well as managing leverage and collateralized accounts. |

| BROKER-DEALER | A broker-dealer engages in the trading of securities both on behalf of its customers and also for its own account. As such, they support liquidity and may act as market-makers. Broker-dealers are often subsidiaries of large financial institutions and banks. |

| INTRODUCING BROKER | An IB accepts orders for exchange traded futures contracts, but does not actually hold customer funds to margin. Client funds to margin are held by a FCM associated with the IB. Because their focus is upon attracting new business rather than order execution, Introducing Brokers often maintain high standards where service, customer support, and educational resources are concerned. |

| FCM BROKER | A Futures Commission Merchant accepts orders for commodity contracts traded on an exchange and holds client funds to margin, and is similar to a securities broker-dealer. Most individual retail traders do not execute directly with an FCM, but through an Introducing Broker. |

| FULL SERVICE BROKER | Full service brokers manage trade execution for their clients, also often providing the research and recommendations upon which their customers trade. |

| DISCOUNT BROKER | Most brokers now offer a discount brokerage service, even if they also act as full service brokers. These firms are able to charge a much lower commission because customers execute their own trades electronically. Discount brokers may also match customer buy and sell orders within the firm’s own order book rather than via an exchange. |

| DEALING DESK BROKER | Brokers who operate a dealing desk model act as market-makers, taking the other side of their client’s trades. Because they provide both a bid and an offer their risk in doing this is minimal. Additional risk can be offset with larger liquidity providers or in derivatives markets. If the dealing desk model is not used, then the broker may be classed as either an STP or an ECN. |

| STP BROKER | Though a Straight Through Processing broker has no dealing desk and does not take the other side of your trades, your orders aren’t directly posted to an ECN either. Instead, the broker manages the bids and offers of various liquidity providers within their own software systems to fill your order at a competitive price. Rather than making the spread or a commission, an STP broker marks up the natural spread by a fixed amount. |

| ECN BROKER | ECN brokers provide direct access to an Electronic Communication Network serving the inter-bank market, where a client’s orders are able to interact with the orders of other participants. ECN Participants post their best bid or offer to the network and the order book or “depth of market” is available to view. Because an ECN broker is not taking the other side of your trade they do not earn the bid-ask spread, and so they typically charge a commission instead. |

Well Why Didn’t You Say?

What do other people say about the broker that you’re planning to open an account with?

It can be helpful to read the reviews and comments on the bestbrokerdeals.com website to see what other people think of a broker’s offering . . .

Have You Undertaken Due Diligence?

While there is no place you can put your money that is guaranteed to be 100% secure (even Fort Knox – just go and watch ‘Goldfinger’!), there’s also no point in taking unnecessary risks by handing it over to some shady and unregulated brokerage firm. There are a number of things that you will want to check out before you go ahead and open an account to ensure that your broker is going to take the safety of your funds seriously. Here are some useful ‘due diligence’ pointers when choosing a broker:

REGULATION

REGULATION

Brokers are required by law to register with the appropriate regulator for the country from which they carry on business. The regulator oversees the broker to ensure that they operate within the law. If a firm has chosen to incorporate in a country without an appointed regulatory body then this may be considered a red flag. For a list of regulatory bodies click here.

CREDIT RATING

CREDIT RATING

How credit-worthy is your broker? Most sizeable outfits will have a credit rating from Moody’s or Standard & Poors – you’ll be surprised how many brokers are actually rated safer than commercial banks! A Guide to the Moody’s Rating System for Brokers.

SEGREGATION OF FUNDS

SEGREGATION OF FUNDS

Brokers can offer additional security by holding funds in separate custodial accounts (the SEC term is “reserve” and the CFTC term is “segregation”). By properly segregating a customer’s assets are available to be returned in the event of a bankruptcy of the broker. This will be of particular concern where a broker also trades for their own account, ensuring that un-segregated funds cannot be used to cover the firm’s own trading losses.

FILED COMPLAINTS

FILED COMPLAINTS

Provided that the activity of a broker is regulated, then any serious misconduct will likely have been reported to the regulator. If there are lots of complaints and they have mostly been upheld, then there’s a possibility that the broker isn’t doing everything it should to keep client money safe.