| Special Offer: 50% Welcome Bonus on Deposits up to $500 – Learn More |

XM have a remarkably clear company mission statement, so while our XM review will score the broker against exactly the same review criteria that we use for all firms to help you compare them, it is worthwhile understanding the particular goals that XM have set themselves as a broker.

The three main areas of focus are fairness and equality, security and regulation, and execution.

XM state that they aim to serve the needs of traders at all levels, drawing on the strength of experience within their team to ensure that all clients are treated equally, regardless of their financial net worth, trading funds, or account type.

Dealing only with investment grade banks and financial institutions, XM takes the security of customer funds seriously. Client deposits are held in segregated accounts, insured for up to €20,000 by the Investor Compensation Scheme, and all accounts have Zero Negative Balance Protection as standard, meaning you can never lose more than the balance of your account.

Finally comes the conviction that execution is the most fundamental aspect of your trading experience. For XM, quality execution doesn’t mean direct market access to an ECN, but it does mean a straight-through-processing with guaranteed execution. In its six years of business, XM has executed over 150 millions trades with absolutely no requotes or rejected orders. So ‘quality’ here signifies certainty, and in a profession where so few things are certain, providing certainty around trade execution is definitely strong selling point that will be attractive to many traders.

| Find out how XM scores against other firms: Compare Forex Brokers |

Commissions & Fees

By aggregating spreads from multiple institutional liquidity providers including Citibank with fractional pip pricing, XM should be able to offer best bid ask prices to its clients and, even with the markup that is incorporated (XM do not charge any commissions), this should equate to competitive, narrow spreads. The broker operates with flexible spreads, allowing it to closely track the interbank market.

XM reports its average spread as 1.7 pips, which is marginally above the average flexible spread of all forex brokers we surveyed, but also less than the average fixed spread for brokers who offer this. While you might be paying a small premium for a guaranteed price with XM, it isn’t as much as the fixed spread that you might pay with other fixed spread firms (one competitor in this regard is EasyMarkets; they currently guarantee your stop loss, no slippage, and no negative balance, but their fixed spreads are almost twice as high). What’s more, spreads remain unchanged regardless of your account type, honoring the broker’s commitment to equality regardless of your funding capability.

If you’re looking for a solid compromise between the security that normally comes with fixed spreads and the competitive quotation that normally comes with flexible spreads, then it seems that XM could be your ideal forex brokerage solution.

| Account Feature |  Micro Micro |

Standard Standard |

Zero Zero |

| Contract/Lot Size | $1,000 | $100,000 | $100,000 |

| Minimum Spread on Majors | 1 pip | 1 pip | 0 pips |

| Commission | ✗ | ✗ | ✓ |

| Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| Hedging Permitted | ✓ | ✓ | ✓ |

| Minimum Deposit | $5 | $5 | $200 |

The three account types on offer cover the range of features that might be expected (essentially a distinction between ‘Micro’ and ‘Standard’ based on lot size, and ‘Zero’ based on execution model), and steer mercifully clear of the gimmicky ‘VIP’ style titles. Of the three types of accounts offered, the micro account will be the most attractive option for most traders, combining the benefits of fees based on interbank spreads with all the flexibility of small lot sizes and a low minimum deposit.

While this framework of account types is fairly standard among XM’s competitors, where things become a little more remarkable is with the following undertaking: “XM is ready to create custom-tailored forex account solutions for every client”. We haven’t tested XM’s willingness to follow up on this promise, but even so it seems consistent with the firm’s core value of equality regardless of a client’s experience or account size.

The ‘zero negative balance’ account feature is also worth noting. Most of us don’t like to think about these worst case scenarios, but if they do occur then this ‘insurance feature’ (which has become more common since the Swiss Franc Crisis of 2015) provides a considerable degree of indemnity, and its value shouldn’t be underestimated.

An inactivity fee is charged by XM, but this is only levied after a full three months of inactivity, and at $5 this is well below the average for those firms we surveyed. An unusual wide range of electronic options are available for depositing and withdrawing funds with no fees attached, although oddly, PayPal isn’t currently supported.

Customer Service

XM has a strong reputation for customer service. Support is available in more than 20 languages, 24 hours per day from Monday to Friday, by live chat, phone, and email. We found XM’s support team to be helpful and knowledgeable in answering our enqueries, although the wait time was a little higher than we would have hoped for. XM prides itself on being a ‘human’ company, and regularly provides its clients with the opportunity to meet its representatives at seminars and events around the globe.

Tools & Resources

XM has a fairly solid range of tools and educational resources on offer, though little that is truly unique or exceptional. Granted, this isn’t where the company has focused its efforts, but our review found this to be a somewhat weaker area for the broker and one where we would like to see XM develop.

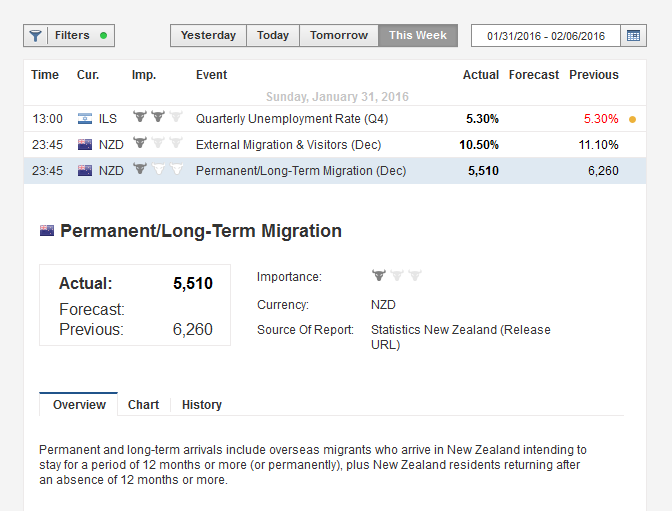

The principal tools on offer consist of an economic calendar and two signals services.

The calendar can be accessed via the website and actually consists of both a schedule of economic events and announcements, complete with prior and expected data and historical charts, and an excellent glossary of economic indicators explaining their significance and common interpretation. Neatly, each report summary provides a link to the external source of the report, making it easy to access and analyze the primary data.

The first signal service is MQL5 from software vendor MetaQuotes, developer of the MetaTrader platform offered by XM. The MQL5 community is home to a broad array of trading signals from providers whose performance has been verified over a one month period. The signal service is a built in feature of the platform and available for all accounts after paying a subscription fee; it can also be used for trade copying with automated execution.

A second signal service is also provided, and this is a little more interesting as it’s powered by one analyst: Avramis Despotis. Once again, access is enable for all account types, and includes twice daily coverage of ten markets. Although the service provides specific entry, stop, and take profit levels, we thought it was actually just as effective for generating trading ideas and incorporating this bias into your own trading strategies.

Where things become a little more comprehensive is with the range of resources provided under XM’s ‘Learning Center’ banner. Here you’ll find daily webinars hosted by 18 instructors in 13 different languages, covering all the basics of forex trading as well as daily market analysis and interactive discussions. If you prefer something more human, XM also host a number of live trading seminars at venues throughout Europe. An informative series of prerecorded video tutorials, meanwhile, provide an excellent guide to the MetaTrader4 platform and will guide you through everything from the absolute basics such as logging into your account through to advanced order placement and indicator templates.

Finally, in the ‘Research’ section you’ll find weekly and daily market outlooks (XM seem to be far more consistent and diligent about keeping these updated than some other firms we’ve surveyed), reviews, and technical analysis reports.

In summary, although everything that XM offers in terms of tools and education is done to a high standard, and the platform familiarization tutorials are an excellent resource, the focus is firmly upon the output of their team of analysts. If you’re looking for any kind of cutting edge tool to assist in your analysis, then XM might not be your best choice, but if you’re fairly confident, self-directed, and no-frills in your approach, then this shouldn’t be an issue.

Trading Platforms

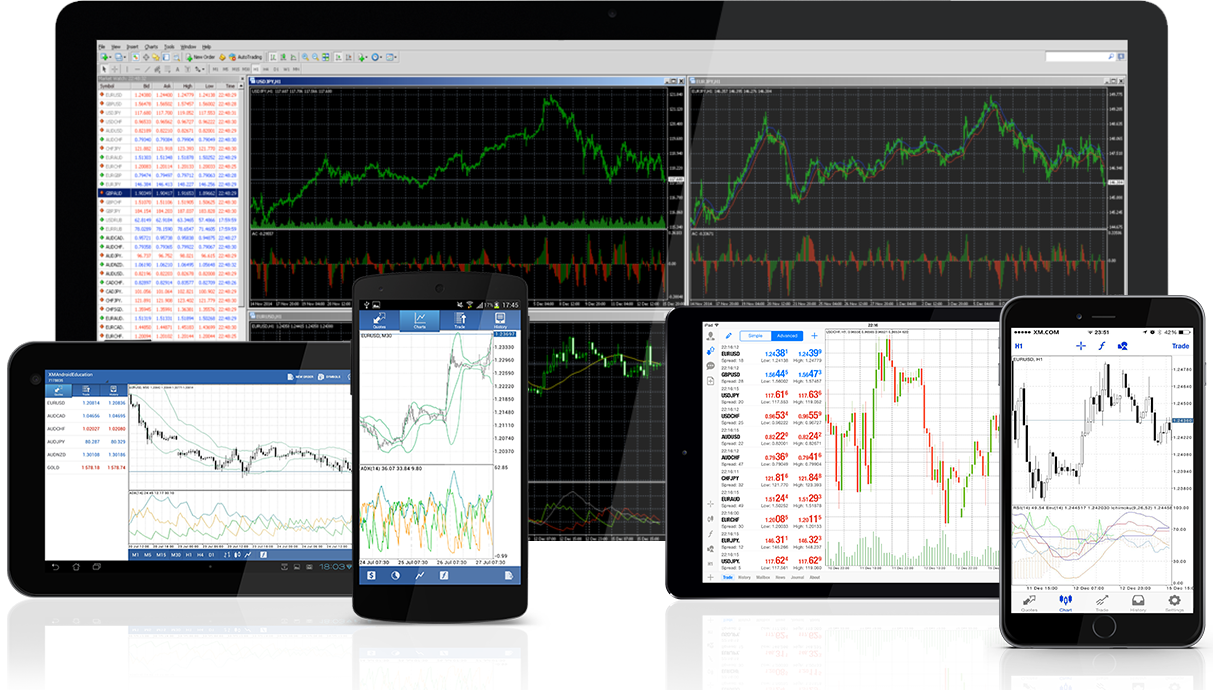

XM offer just one trading platform, MetaTrader4, with options for use across a full range of devices (plus multi-terminal). While we never penalize a broker for a streamlined range of platforms and aim to assess them on their merits, if you’re not comfortable using MetaTrader4 as your core trading platform then XM simply isn’t a broker that should be on your shortlist.

For the purposes of the remainder of this review we will be focusing on XM’s browser based version of the software. The platform is accessed via your web browser and requires no download or installation.

Upon first loading, the XM MT4 browser platform appears to offer an uncluttered and professional workspace. Switching between timeframes and instruments is simple, and it is possible to keep multiple charts open in tabs along the bottom of the screen. Open orders and P&L do not display as default, however, and must be added in a separate window.

There’s a reasonable amount provided here in the way of visual customization – if you want your charts on a black background or without the grid, then that’s all easily achieved, as is toggling between line, bar, and candlestick charts. Volume loads as default (this is forex volume executed by XM clients only), but can be turned off. What is harder to customize is the layout and proportions of the screen. A large strip across the top is devoted to nothing more than the broker’s logo and access to account management and live chat support; these could easily have been incorporated via a menu and would have meant far better proportions for chart display. By the time you’ve added an indicator in a subpane, the price chart can become little more than a strip on rectangular monitor.

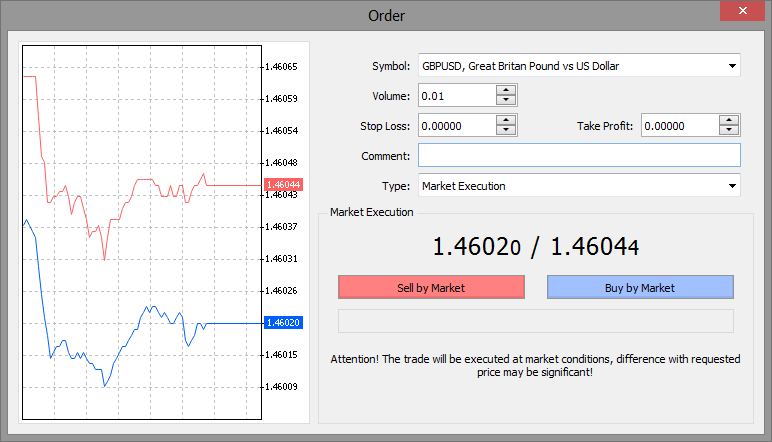

One-click order entry, once enabled, is accomplished via the buy and sell buttons up at the top left of the chart. Navigating to the entry parameters to submit limit orders is a little cumbersome as you have to go via a popup submenu, but once you’re there the order entry dialog box itself is very straightforward and has a spacious layout. One feature we particularly liked here was the inclusion of a graphical display of the spread, which should aid in identifying adverse execution periods and wide spreads. It’s also possible to attach a comment/rationale label to orders to help identify them when reviewing your positions.

The types are limited to market orders, stops and limits, and we couldn’t find any support for conditional or bracketed order types.

Analysis from the chart covers all the basics (common indicators, fibonacci tools, and the ability to draw trendlines), but pretty much ends there. The range of indicators on offer from the Webtrader platform is extremely limited, although a full suite of analysis tools is available within the Desktop platform.

We did find that it was possible to mark up the chart with comment boxes, which once again enable you to review the thought processes behind your trading and recall the analysis that led you to place trades – a handy functionality, especially for those who are learning.

Conclusion

Overall, we found that XM does an excellent job of delivering on the promises of its mission statement. It is well equipped to compete with the products of other firms and in many areas beats them hands down in terms of its ethics and service levels.

The execution model the broker employs provides many of the benefits of both ECN and Dealing Desk models, offering the flexibility and competitive pricing of interbank quotes with the security and stability of zero balance protection, flexible spreads, and a guarantee against rejected orders. All the indications are that XM takes compliance more seriously than most, as evidenced by it’s choice to work with an extensive number of regulatory bodies around the world. We also identified numerous clear signs that XM delivers on its pledge to treat all account holders equally in the way accounts benefits and resources are structured.

The tools and educational materials we examined were all good and XM has assembled a diverse team of analysts, but this was the area in which we felt the broker could maybe offer more, developing unique analysis tools that can’t be found elsewhere. Although the charting platform does not provide any exceptional or advanced functionality, it will fulfill the needs of most traders, and as the desktop version is also supported by XM then those requiring more control will doubtless gravitate towards this.

| Location | Minimum Lot Size |

Minimum Deposit |

Maximum Leverage |

Funding Methods |

Monthly Inactivity Fee |

|

| Cyprus | $1000 | $5 | 888:1 | Wire, Card | $5 | |

| Platforms | Devices | Regulator | Chart Trading | EA/Algo Trading | Demo Available | |

| Offer: 50% Welcome Bonus on Deposits up to $500 Learn More |

MT4, MT4 Mobile | Desktop, Tablet, Mobile | CySEC, FCA, +Others | ✓ | ✓ | ✓ |

| Special Offer: 50% Welcome Bonus on Deposits up to $500 – Learn More |