Futures are a derivative product that offer a great deal of leverage, allowing you to enhance returns with a relatively small initial capital outlay.

Using a small deposit in your account, known as ‘margin’, leverage enables you to buy or sell a contract with a much higher face value. The initial margin requirement to open a position is typically 5 to 10 percent of the contract value. Your position is ‘marked to market’ on a daily basis, and you will be required to keep a certain amount on deposit to maintain your position.

Futures Margin versus Margin in Stocks

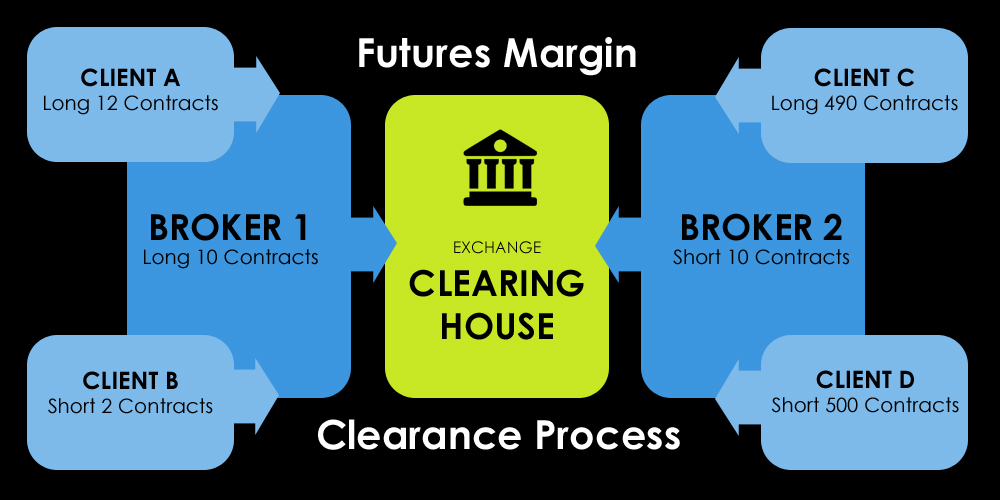

Margin in futures is unlike margin in stocks. Margin does not imply a partial payment for futures traders, as no actual physical transaction occurs (until the expiration date), but is simply a good-faith deposit. This deposit is made (through your broker) with the clearing house of the exchange, and unlike with stocks, futures leverage does not require the loan of funds from your broker, which means that there is no interest to pay.

3 Types of Margin

There are two types of margin requirement set by the exchange, initial margin and maintenance margin. Initial margin is the amount that is required to initiate a position, and the maintenance margin is the minimum amount that must remain on deposit in order to maintain the position (typically 80-90% of the initial margin). If trading losses cause your balance to fall below the maintenance margin and you do not meet a margin call then your position will be liquidated at the market value.

There are two types of margin requirement set by the exchange, initial margin and maintenance margin. Initial margin is the amount that is required to initiate a position, and the maintenance margin is the minimum amount that must remain on deposit in order to maintain the position (typically 80-90% of the initial margin). If trading losses cause your balance to fall below the maintenance margin and you do not meet a margin call then your position will be liquidated at the market value.

A third type of margin, the daytrade margin, is set by your broker and only applied to positions during the day. If these positions are not closed out by the end of the regular trading session then they will be marked to market according to the exchanges maintenance margin rules.

Futures Leverage ExampleSuppose that the ES (e-Mini S&P) futures contract is trading at 2071.50 Each point in the ES is worth $50, so the face value of a single contract is: 2071.50 x 50 = $103,575 The maintenance margin set by the exchange for this contract is currently $4600, so you can maintain an overnight position in this market with just 4.44% of the full contract value on deposit. A typical online discount futures broker’s daytrade margin is around $500 for this contract, meaning that you may maintain an intraday position by depositing just 0.48% of the full contract value. |

How Leverage Benefits You

The tremendous leverage on offer is one of the key attributes that attracts new traders to the futures markets, but it must be remembered that leverage is a double-edged sword; leverage increases both gains and losses in equal measure. The undisciplined use of leverage is one of the reasons that futures carry a reputation of being a high-risk product.

Leverage is expressed in terms of the ratio of the position you control to the amount of your deposit. If we refer back to our example above, you’ll recall that a deposit of $4,600 allowed you to control a contract with a value of $103,575. This means that for every dollar in margin you control $22.50 worth of contracts, and your leverage is therefore approximately 22:1.

Because positions are only marked to market by the exchange at the end of the trading day, the margin that is required for a position that is entered and exited on the same day is determined entirely by your broker. This is known as the ‘daytrade margin’. If you are planning to trade intraday, then the daytrade margin required by your broker is an important factor to consider when choosing a futures broker.

The table below shows examples of daytrade margin requirements for a selection of popular futures contracts across three futures brokers. As you can see, there are significant differences between them. The daytrade margins for Crude Oil and 10 Year Note futures with TradeStation are exactly the same as the maintenance margin for these contracts.

| E-Mini S&P (ES) | Crude Oil (CL) | 10 Year Note (ZN) | |

| Trade Station | $1,265 | $4,600 | $1,350 |

| Apex Futures | $500 | $750 | $811 |

| Cannon Trading | $500 | $750 | $300 |

The Dangers of Leverage

The dangers of using leverage for futures trading can be stated very simply: leverage increases losses as well as enhancing returns. In other words, the use of margin will increase the size of your losing trades in exactly the same way as it increases the size of your winning trades. Leverage affects profits and losses in equal measure.

Some aspects of leverage that are unique to futures are as follows:

- Leverage is “built in” and not optional like with stocks and ETFs. All futures trading is carried out in a margin account and the initial margin amount will be placed with the clearing house by your broker; you cannot deposit more than the required margin with the clearing house.

- The amount of leverage that you use cannot be varied. Reducing leverage is one of the common strategies that traders use to manage risk. The only way to vary leverage with futures is by varying the number of contracts that you are carrying.

- Futures markets can become “locked limit”, making it impossible to exit a losing position. In order to curtail extremely volatile price behavior, futures markets may only move by a limited amount during each trading day. If they reach the limits prescribed by the exchange the market is said to be “limit up” or “limit down” and trading ceases. Combined with the leverage inherent in this form of derivative, this can lead to significant losses.

E-Micro Futures Contracts

If you’re concerned that the leverage involved in futures may be too high or you only have a very small amount of trading capital, then you might wish to consider trading a new, smaller sized electronic contract called the e-Micro.

If you’re concerned that the leverage involved in futures may be too high or you only have a very small amount of trading capital, then you might wish to consider trading a new, smaller sized electronic contract called the e-Micro.

These contracts are currently available for a range of the most popular markets, including the S&P, Crude Oil, and Gold, as well as the six major currency pairs.

Using Leverage for Futures Trading

It is one of the main characteristics that attract traders to use futures contracts, and it creates significant opportunity. Leverage is also an essential part of futures trading and cannot be avoided, so futures are only a suitable choice for those who are prepared to learn how to manage risk, are adequately capitalized, and are focused on maximizing returns for a minimal investment. Many futures traders in the retail sector of the market (though not in the fund management sector) concentrate on shorter term daytrading strategies, taking advantage of the low margin requirements of discount futures brokers.

| View the next futures article: Selecting a Futures Broker |