The Rise of High Frequency Trading

In case you don’t know, High Frequency Trading (HFT) is big business!

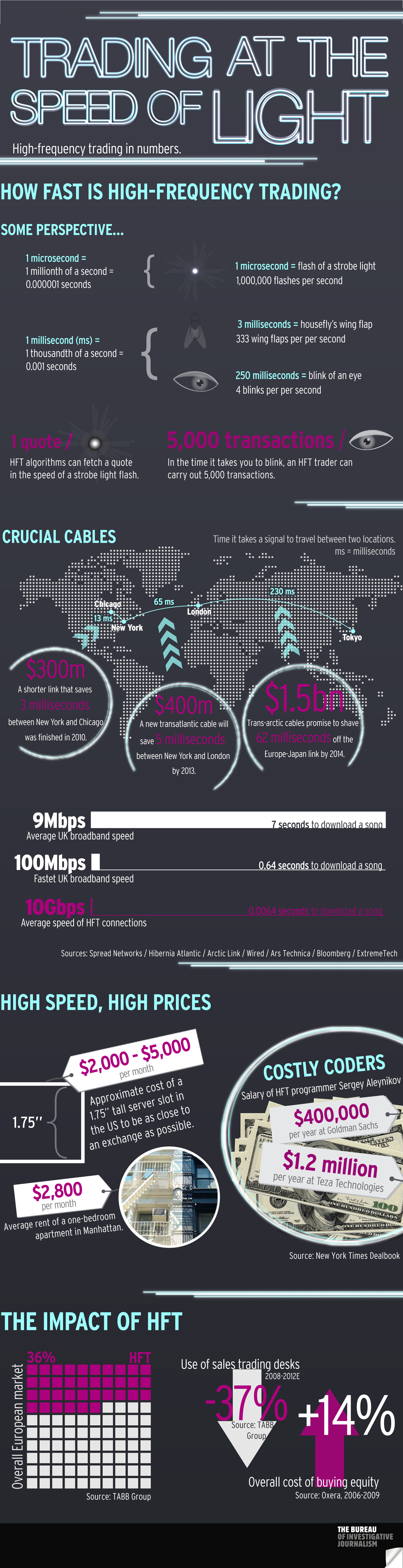

In 2014 trades lasting less than 1 millionth of a second and executed by machines dominated the markets, accounting for somewhere in excess of 70% of all transactions in stocks traded on US exchanges. More recently the attention of these firms turned to the less closely regulated Spot Forex, and in the last year the volumes attributed to HFT rose to more than 35% according to Bloomberg.

The fascinating infographic at the bottom of the page tells you pretty much everything you need to know about the incredible speeds at which these market participants operate, and the technological infrastructure they are prepared to invest in to remain competitive.

What HFT Means for You

It is almost certain that the counter-party to some of your trades will have been an HFT firm.

So where does all this leave you, with your home broadband connection and retail brokerage account? Many traders like to believe that HFT has nothing to do with how they trade, almost as if these outfits operate in an entirely different market to the ones you and I do. But this is a mistake – ignore HFT at your peril!

The HFT Survival GuideThe very nature of high frequency trading tells you virtually everything you need to know about how these participants operate: speed is absolutely critical to the success of their strategies because they don’t hold positions for long periods.

They have displaced these older breeds of participant both because of the speed at which they operate, and their ability to provide liquidity and offset risk across thousands of markets simultaneously. High Frequency Trading firms mostly attempt to buy a market at the bid and sell it at the offer, earning the spread and any liquidity provision rebate that comes with it. This means that when you want to take liquidity by placing a marketable order with your broker, the presence of HFT typically benefits you. When you want to provide liquidity yourself, however, buying at the bid or selling at the ask with a limit order, then you are forced to compete against HFT firms to get your order to be filled. The best way to reduce the possibility of HFT impacting upon your trading is to trade in higher time-frames. Trading from hourly, daily, or weekly charts should mean that the impact of the spread on your trading is negligible. If the HFT firms want to nickel-and-dime you on the way in and the way back out then it simply won’t matter; you’ll be counting your profits in dollars! |

To find out more about the rise of High Frequency Trading we recommend either of the two books below, each of which cover the topic from a non-technical and journalistic perspective, charting the rise of automated trading and the processes used by HFT firms to profit.

|

|

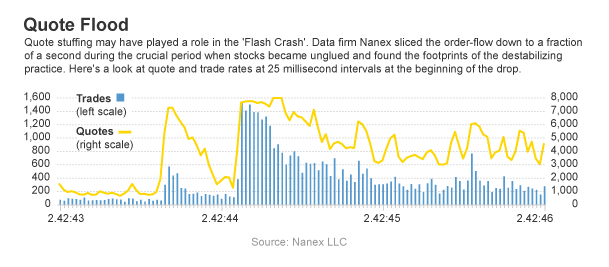

Eric Hunsader’s site at Nanex.net provides a research and information hub exposing the practices of the HFT industry through extensive data mining exercises.

| View similar articles about investing in stocks: Stocks Knowledge Base |

HFT firms are nearly all liquidity providers. They occupy approximately the same space as that which Market Makers, Floor Traders, and Scalpers used to profit from.

HFT firms are nearly all liquidity providers. They occupy approximately the same space as that which Market Makers, Floor Traders, and Scalpers used to profit from.