Limit orders are one of the two most basic order types that are available to futures traders, and can be executed through all brokers.

Using Limit Orders for Futures Trading

A limit order enables you to initiate a position at a price that is more favorable than the current one. A limit buy order is always placed below the level that the market is currently trading at, while a limit sell order is placed above the current price.

How Limit Orders Are Filled

Unlike a market order (such as a stop order), which executes as soon as it reaches the exchange, a limit order is queued on the order books of the exchange and can be viewed by other market participants. If you are willing to trade via a limit order at any particular price, then everyone else can see this information in their data feed.

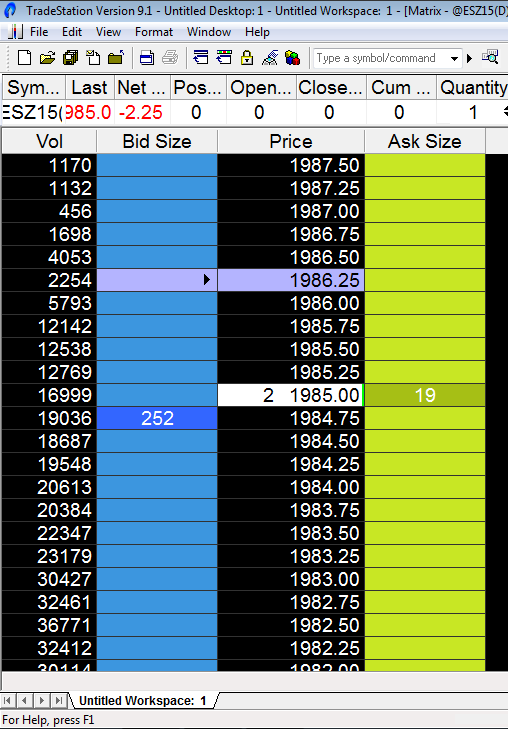

Take a look at the image below, which shows the depth of market for an electronically traded futures contract. We can see, that the highest queued buy orders are at 1984.75, and that there are 252 of them. Because the lowest price at which anyone is willing to sell is 1985.00, where 19 limit sell orders are queued, no trade can currently take place between these 252 buyers and 19 sellers. Limit orders do not interact with one another. In order for any of the sell limit orders to be filled a buy market order must fill them. You can see that at the time this image was captured two market buy orders have crossed the spread to fill two limit sellers at 1985.00.

It should be obvious that if you can sell short using a limit order at 1985.00 and then immediately buy to cover with a limit order at 1984.75, then you will have made a profit equal to the spread (one tick). This is precisely what “scalpers” or market-makers do, and it is a lot harder to do than you might imagine! Traditionally this market-making activity in futures was carried out by the “locals” on the exchange floors; nowadays it is mostly done by HFT firms due to the speed at which electronic futures markets operate.

If you had a sell limit order at 1985.00 and the market traded at that price, it would not necessarily be filled. It would depend on your position in the queue of orders at this price. If only 16 buy market orders come in at that price and your order is 18 in the queue, then your order will not be filled. In order to be certain that a limit order would have filled, price would need to trade through it, with transactions occurring at 1985.25. While a limit order guarantees the price at which it will be filled, it doesn’t ensure that it will be filled.

Viewing the Limits Orders of Other Traders

Unlike market orders (including those held by brokers as stop orders), any limit order sent to the exchange is visible to everyone with access to the exchange’s data feed via their broker or charting platform. Nobody can see your individual order, however, or whether it’s for a single contract or hundreds; all participants see exactly the same aggregate data that is visible in the depth of market screenshot above.

Unlike market orders (including those held by brokers as stop orders), any limit order sent to the exchange is visible to everyone with access to the exchange’s data feed via their broker or charting platform. Nobody can see your individual order, however, or whether it’s for a single contract or hundreds; all participants see exactly the same aggregate data that is visible in the depth of market screenshot above.

Though it is useful to have a working knowledge of how different futures order types interact, a topic known as ‘market micro-structure’, it’s not actually likely to be too important to your trading.

Pros & Cons of Limit Orders

| ADVANTAGES | DRAWBACKS |

|

|

Using Limit Orders as Profit Targets

It is common to use limit orders as a means to take profits at a predetermined price level. For example, if you initiate a long position at 1910.00 (using any type of order) and you wish to take profits at 1920.00, then you want to sell at a higher price than you bought to enter. You can do this by placing a sell limit at 1920.00. Often traders will place both a profit target limit order and a stop-loss stop order at the time their entry order is filled.

TIP: If price trades up to your hypothetical order at 1920.00, it is not certain that your limit order will be filled. In order to avoid giving back profits it is useful to set a stop order one or two ticks below your profit target. This is only set once your profit target is touched, still giving the limit order chance to fill for a larger profit at 1920.00.

| View similar articles about investing in futures: Futures Knowledge Base |