In this series of articles we have been employing some simple statistical analysis to try to ascertain when during the day a particular market is most active, and might offer the best opportunities for intraday trading. In this week’s study we’ll be examining the GBP/USD forex pair, studying both volatility and volume to answer the question “when is the best time to trade the British Pound?”

Despite its status as the oldest currency still in use today, Pound Sterling may easily have vanished in the 1990 as other European countries all adopted the newly established Euro. It continues to be held as a reserve currency by central banks worldwide, though in significantly lower amounts than the US Dollar or the Euro.

Our previous investigations into the Yen and the Euro have revealed a tendency for enhanced trading volumes in a currency’s “home” timezone; it will be interesting to see whether this is also the case for the Pound, whose London home is also the world’s leading center for foreign exchange trading.

Analyzing the Data

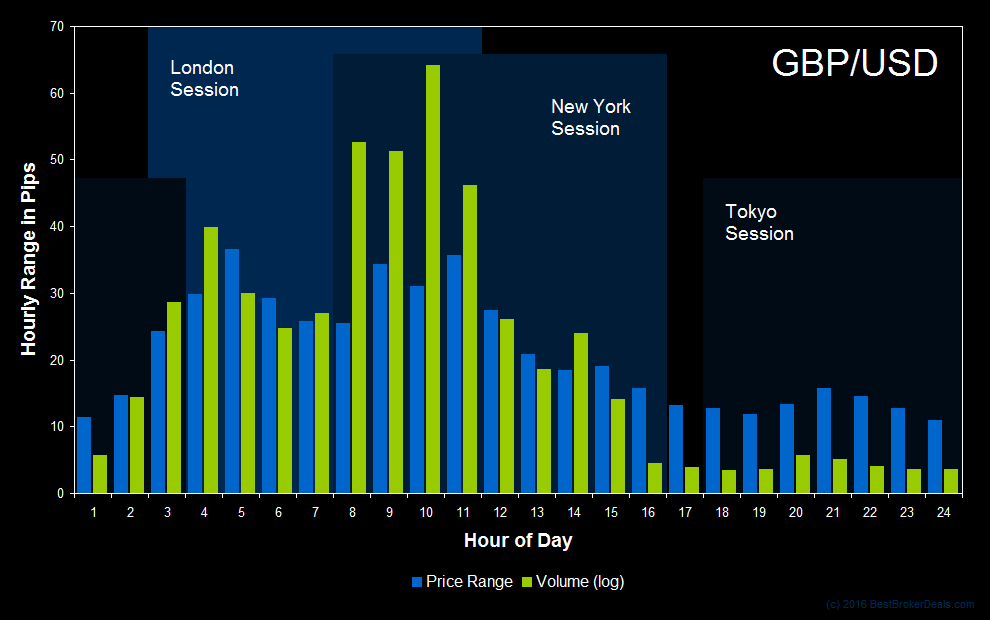

As with all articles in this series, we’ve looked at five years of intraday price data (providing roughly 250 data points for each individual hourly period), and have used quotes from the GBP/USD spot forex market. Volatility is measured simply by hourly range in pips, and all times are EDT. The chart below also includes volume data. This has been taken from the full size British Pound Futures Contract (@BP) which trades on the Chicago Mercantile Exchange, and the data has been scaled to fit with the price data.

The Best Time to Trade the British Pound

Though the patterns we see here aren’t completely different to the results of our Yen and Euro analysis (each of the three international forex trading center opens is accompanied with pronounced volume and volatility), there are a few noteworthy differences.

The greatest volatility is seen, as we thought it might be, following the London open. The volumes accompanying this volatility peak, however, are nowhere near as significant as those we see in the US markets later in the day. This is interesting, as low volumes can be associated either with a lack of speculative interest in a forex pair and a quiet, ranging market, or with a lack of liquidity and volatile behavior. If the market is thin then an influx of one sided interest can cause price spikes and stop runs.

Looking towards the end of the trading day we can see that volatility is less pronounced in the Asian session than in our other studies. Traders in the Far East are less likely to move the British Pound, it seems. This could be useful information to keep in mind if you are considering holding a position in GBP/USD overnight following the close of the US session: on average you’re not likely to have to endure significant volatility until the London open the following day (obviously, exceptions will apply!).

How to Use This Analysis

The great thing about this kind of statistical analysis is that you can incorporate it as part of an automated strategy with strict rules, but you can also use it as one of many inputs in a broader discretionary decision making process. However you trade, information like this should be useful.

Nevertheless, in the investigative spirit of this piece, I would encourage you to carry out your own research so that you can be absolutely confident in the results you see and their relevancy to your own strategies. All the research in this article was completed using TradeStation and the data was presented using Excel, but pretty much any good broker’s charting software will support this type of investigation.

| View the next article in this series: The Best Time to Trade the Australian Dollar |