It is reported that Canadian stock brokerage TD Ameritrade has experienced a brief platform outage following the results of the UK Brexit referendum result. Customers were apparently unable to login and execute orders via the broker’s usually reliable online platform for around an hour, and clients were directed to the company’s support lines for assistance in closing open positions.

| View offers and discounts from this broker: TD Ameritrade Promotion |

The problem seems to have related to messaging volumes placing strain on the company’s IT infrastructure, rather than issues surrounding liquidity. A company spokesperson explained:

This morning’s heavy volumes across the industry caused some brief messaging and login delays. Everything is now functioning normally.

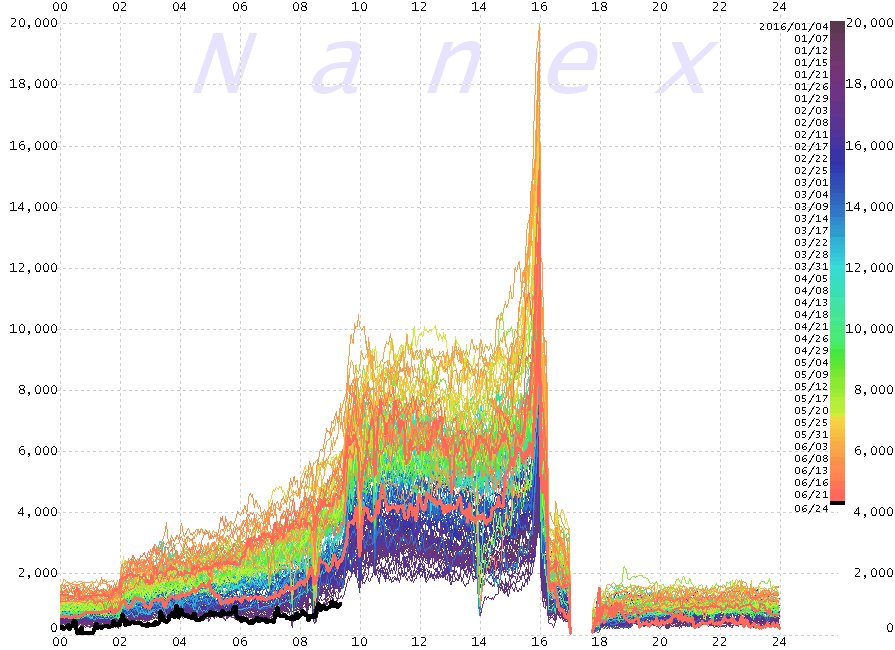

The Brexit vote has shaken both equity and currency markets, which had rallied steadily prior to the event on the expectation of a decision to for the United Kingdom to remain as part of the EU single market. Following the result, huge amounts of sell-side volume entered the markets as both the FTSE100 and the British Pound plunged, dragging the S&P and Asian markets down with them. The image below, from market researchers Nanex, illustrates the dramatic shift in liquidity:

Both brokerage firms and other financial institutions seem to have been relatively well prepared for the possibility of this outcome, and TD Ameritrade is so far the only firm to have reported any problems, with most brokers so far navigating through the event unscathed. This is in stark contrast to last year’s Swiss Franc liquidity crisis, a similar shock event which placed considerable strain on both the IT systems and capital reserves of many firms, leading to huge trading losses and a number of brokers entering insolvency.

Although the a referendum exit was considered unlikely, brokers including TD Ameritrade and were well-primed, technology providers anticipated increased order flows and margin requirements had been increased before the event. Due to the increased volatility a small number of firms introduced a close-only condition for brief periods while markets stabilized. While this prevented some traders from accessing the markets to take advantage of perceived opportunity, it clearly proved an effective method of managing risk.